What you get

Production tokenization platforms require more than smart contracts. We deliver end-to-end systems: asset modeling, backend services, integrations, indexing, and operational support.

We build the core layers that make tokenization usable in real operations - not just a contract on-chain.

Asset model & lifecycle design

+Define ownership model, issuance/redemption flows, transfer rules, and lifecycle events. Output: clear spec that maps business rules to on-chain + backend components.

Smart contracts

+Implement token logic, permissions, upgrades, and robust test coverage. Output: production-ready Solidity (and XRPL flows when applicable) plus deployment pipelines.

Backend services & integrations

+Issuer/investor workflows integrated with your existing stack and third-party providers you choose. Output: APIs, services, and integration hooks for onboarding, ops, and reporting.

Indexing, reporting & data integrity

+Turn blockchain events into usable operational data for finance, ops, and product teams. Output: indexers, data pipelines, and audit-friendly reporting outputs.

Launch readiness & production support

+Make releases safe and systems observable under real load. Output: monitoring, runbooks, incident response basics, and post-launch support.

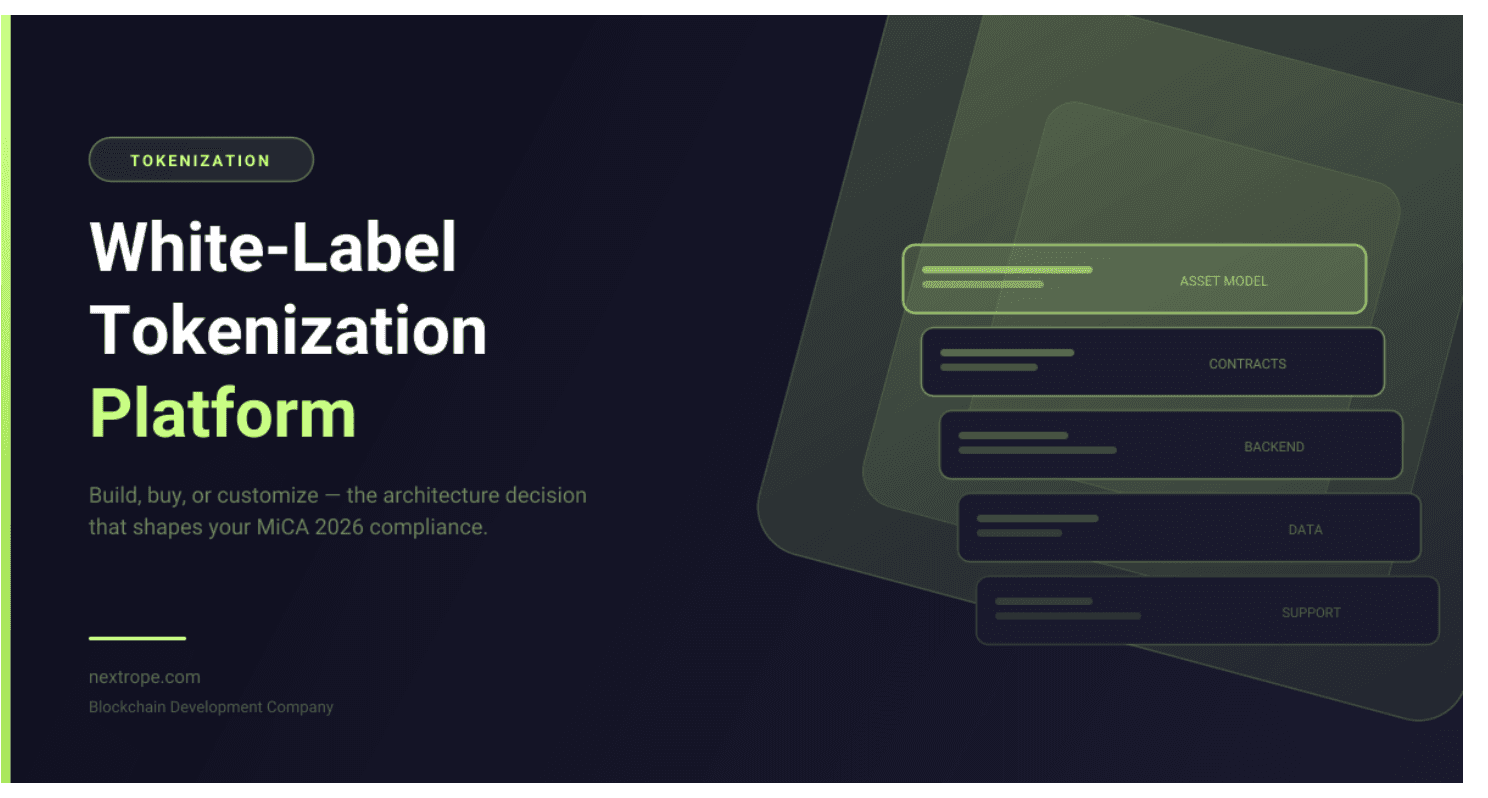

Core architecture

Issuer ops layer

+Admin workflows, approvals, and lifecycle controls.

On-chain layer

+Token contracts, permissions, upgrades.

Integration layer

+Onboarding/identity providers, internal systems, analytics.

Data layer

+Indexers, event pipelines, operational reporting outputs.

Support layer

+Monitoring, runbooks, safe release practices.

Common use cases

Real-world tokenization scenarios where production infrastructure matters.

Private credit & receivables

+Tokenized issuance flows and lifecycle events connected to real-world asset operations.

Commodity-backed assets

+Issuance and redemption-oriented flows with strong operational traceability.

Real estate / fund-style structures

+Ownership models and lifecycle logic designed around real constraints and integrations.

Enterprise proof + verification layers

+When tokenization needs verifiable proofs or long-term integrity anchoring (e.g., regulated document flows).