The world's pandemic is constantly affecting our daily lives, forcing us to redefine our view of many branches of life and business. Recent days have brought many dynamic changes, and more are constantly appearing on the horizon. But are there also new opportunities besides new problems? Where can blockchain allow us to adapt to the current situation?

Supply and distribution of medicines and medical equipment

In crisis situations, the management of the supply of medicines and medical equipment is a key issue which, as the covid-19 pandemic shows, should be secured globally, and any mistake can have tragic consequences for hundreds of patients. The current situation shows how flawed modern systems can be, which are unable to protect us e.g. from periodic shortages of products as important as masks.

The supply chains of protection agents or medicines are extremely sensitive and susceptible to manipulation, and many parties with different and sometimes even conflicting interests are involved in them. Blockchain provides a secure platform to solve this problem, introducing greater data transparency and better product traceability. Because a blockchain record can only be verified and updated with a "smart contract", manipulating the block chain is also very difficult.

Blockchain allows to work out a compromise and trust at protocol level between all parties involved. This is crucial in situations where demand for a particular product exceeds supply and product availability may prove to be inadequate to actual demand. Blockchain can allow us to create a decentralised system for the distribution of medicines in which the interests of one party do not take precedence over the other.

One of the companies working to secure the drug supply chain using blockchain and IoT technology is Chronicled. The company has been on the market for several years now, implementing decentralized supply chain ecosystems and building a protocol-based solution to improve global trade in key industries, including pharmaceuticals.

Banking services

The world's coronavirus pandemic forces us to redefine our view of many branches of business. Sources such as The Economist and Forbes have been telling us for several weeks about the real risk of a global economic crisis comparable to that of 2008. One of the sectors that are certainly facing dynamic changes is the financial one.

Before 2008, banks had little competition, which allowed them to monopolise financial services. This allowed them to charge high commissions, add hidden fees to the rates offered or overstate currency margins. It was them who dictated the conditions - if the consumer needed money he could only go to them. When it comes to the financial services market, there was practically no other choice. Customers often followed the rules created by banks, which were often unfavorable for them, because they usually had no other viable options.

However, the events that started with the collapse of Lehman Brothers in September 2008 led to an accumulation of aversion to the financial system at the time, which was accompanied by a general lack of confidence in the banking sector. Changes in customer mentality triggered a demand for different solutions from the previous ones, which created an opportunity for new players to enter a market where they started to offer better, more competitive services. This has triggered dynamic changes in the industry.

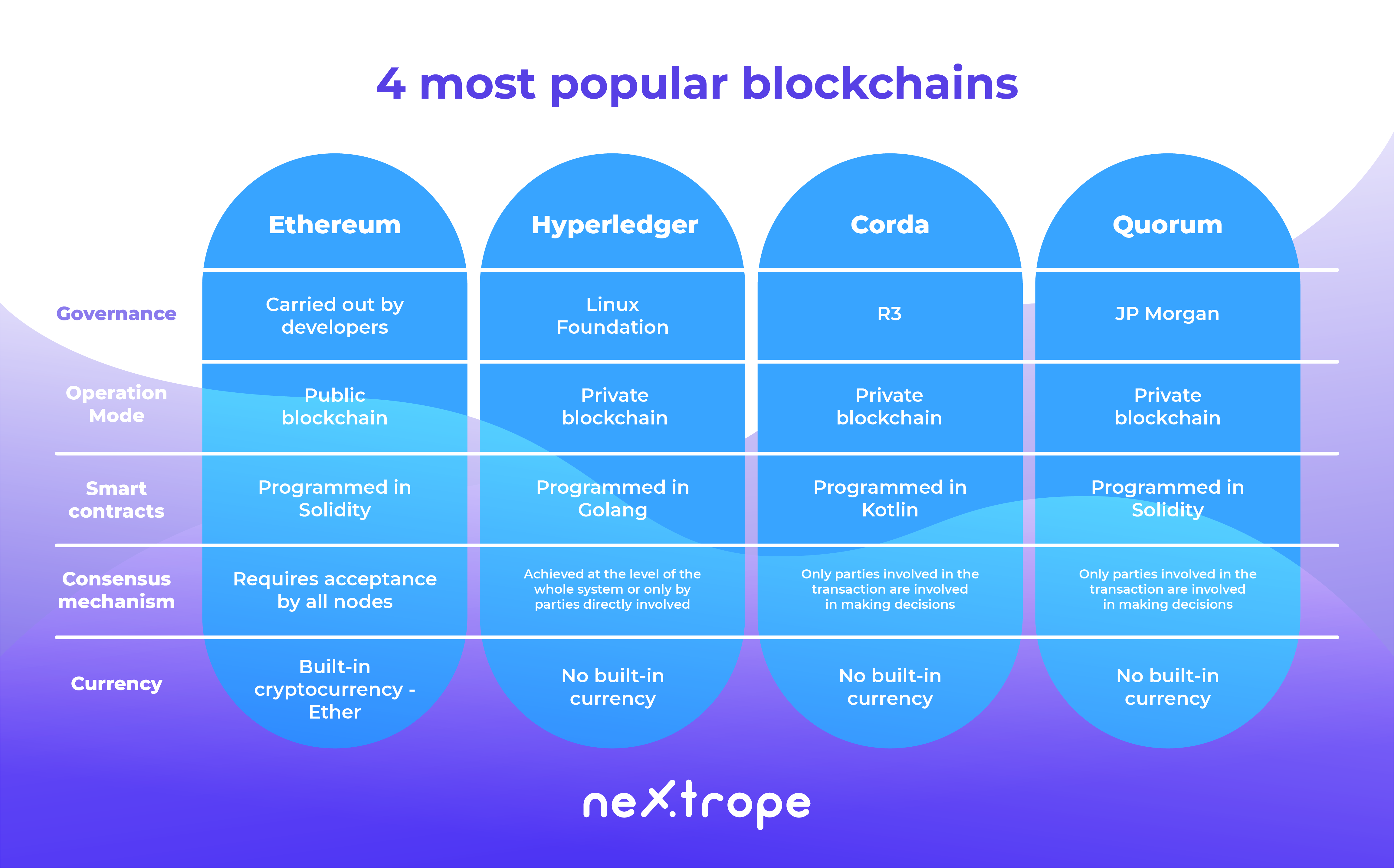

An example of using blockchain technology on the banking services market is Request. This decentralised network based on Ethereum enables users to, among other things, perform transactions between themselves, send or request payments or issue invoices. Whereas developed by Symbiont and Ipreo companies Synaps using blockchain-based smart contracts seeks to improve and automate the market for credit syndicates.

Today, when the coronavirus pandemic brings with it another threat of financial crisis, the demand for fintech is likely to increase sharply again. Many consumers will lose confidence in the traditional form of banking services and start looking for alternative options. Again, this will create an opportunity for those who will offer new, innovative products based on modern technologies such as blockchain, offering opportunities such as peer to peer transactions or the decentralisation of asset transfer.

Verification of identity

The reduction of social relations contributes to the growing popularity of remote communication tools. This will create a demand for solutions for authentication of digital certificates and identities verified by cryptography, not by the participation of a person. Basing the verification process on blockchain is simply cheaper and more secure than using a third party. At a time when the lack of trust in relationships, especially business relationships, seems to be a common problem, obtaining it at the level of IT protocol seems to be a solution created for the needs of the modern market

An example of a company operating in this area is Spanish Validated ID provide digital identity solutions designed primarily for remote working and e-commerce. Their ViDSigner is a comprehensive electronic signature service that allows users to issue honored signatures in several ways - including a sliding card, biometric signature or automatic seal.

New, safer asset transfer methods

Transferring business interactions to the Internet will increase the demand for secure asset transfer methods. Blockchain seems to be the ideal solution here. For several years now, we have been observing how the tokenization and trading of assets in a decentralized system based on it is gaining popularity in various industries, including those as different from each other as real estate and music. When a blockchain occurs, the need to engage an external third party disappears, so that asset transfer processes can be faster and become cheaper to maintain. Additionally, recording transaction data in the blockchain reduces their vulnerability to manipulation or fraud.

Such solutions are implemented by 2014, among others, by the company Bitmark, which claims that although modern societies have developed property rights and intellectual property rights, they have not protected digital content. Therefore, through the use of blockchain technology, it enables the transfer of digital content in a peer to peer system, including health data, digital art collections, music rights and medical records.

Certificates of authenticity based on cryptography

According to Maciej Jędrzejczyk. CEE Blockchain Leader’a at IBM may reveal many inaccuracies in the supply chain depending on demand and production from China. This will lead to the disclosure of counterfeit certificates of authenticity of parts of the products originating from there. As he predicts, "this will lead manufacturers to use irrefutable proofs of origin based on cryptography rather than on authority".

Blockchain can record transactions in the supply chain and provide a unique identity for each product unit, tracking its journey in the supply chain. In addition, the unit can be paired with an NFC chip, QR code or RFID tag to enable real-time digital recording of progress. The Shanghai company is already working on this mechanism VeChain dealing with the problem of authenticating luxury goods.

Hope for the entertainment industry

The entertainment industry seems to be one of the most affected by the outbreak. Thousands of cancelled concerts, festivals and other music events have brought and will bring losses of many millions. In a market dominated by giants such as Spotify, iTunes and YouTube, the creators will suffer most. While streaming portals are more active, the royalties paid to artists represent only a small percentage of the profits from playing their music. Blockchain-based portals such as Opus and Vezt, which are able to pay artists almost 100% of the profits thanks to the use of blockchain technology, become an alternative for artists. For many artists, they can be the key to survival in such a rapidly changing market.

The consequences of the current situation will be coming back to us severely in the coming months. However, in addition to numerous threats, there are also new opportunities. It is up to us whether we will be able to take advantage of them and limit the losses resulting from the pandemic. The technology may again prove to be irreplaceable here. We will probably need modern solutions such as blockchain as never before.

Reducing losses, solving current problems and adapting to upcoming changes are areas where modern technology will prove necessary. In the context of an epidemic, many blockchain-based solutions turn out to be even more valid, there are also new areas where the implication of this technology may be the most optimal choice. The coming weeks will require the implementation of significant changes in many branches of business, without a doubt blockchain is a technology able to do this.

en

en  pl

pl