The real estate market is undergoing a significant transformation with the emergence of tokenization, a process in which real estate assets are converted into digital tokens stored on a blockchain, allowing for digital ownership and the transfer of fractional shares. With a market size of around $200 million, real estate tokens account for nearly 40% of the digital securities market, making them an increasingly popular investment option.

Read our article about the Real Estate Market

The Process of Real Estate Tokenization

Incorporating blockchain technology, real estate tokenization is a groundbreaking method that combines the conventional real estate sector with modern advancements. The procedure takes place as follows:

1. Choosing an Asset

Initially, a particular real estate asset must be chosen for tokenization. This may include any type of property, such as residential houses, commercial buildings, or even vacant land.

2. Assessing Value

Professional real estate experts and appraisers undertake a comprehensive analysis of the property to establish its market value, ensuring accuracy in the process.

3. Establishing Legal Structure

Due to the intricate nature of real estate transactions and the novelty of tokenization, a legal framework is implemented. This could encompass the creation of a Special Purpose Vehicle (SPV) possessing the real estate asset, which then issues tokens symbolizing ownership shares in the property.

4. Generating Tokens

With the legal structure in place, blockchain technology is utilized to produce digital tokens. Each token signifies a portion of the property's ownership; for example, if a $1 million property generates one million tokens, each token represents $1 of the property's value.

5. Implementing Smart Contracts

These coded agreements on the blockchain automate and adhere to contract terms. In real estate tokenization, smart contracts may automate procedures like distributing dividends to token holders (if the property produces income) or defining conditions for selling or transferring tokens.

6. Token Sale or Allocation

In an initial offering comparable to a stock market IPO, investors can buy tokens or property shares. In some instances, these tokens can also be exchanged in secondary markets, offering liquidity for investors.

7. Managing Property

Even though properties are tokenized, essential management tasks remain necessary, such as dealing with maintenance, leasing, and other routine real estate functions. Token holders receive revenue distribution based on their shares (e.g., rent), with smart contracts streamlining the process.

8. Trading and Liquidity

Tokenization's main advantage is the possibility of enhanced liquidity. Once the initial token offering is complete, investors can trade tokens on secondary markets, enabling more accessible buying and selling of real estate shares, resulting in a more liquid investment than traditional real estate.

9. Exiting and Redemption

Investors seeking to leave their investment can sell tokens in the secondary market. Moreover, provisions may exist for selling properties, with proceeds being distributed among token holders according to their token count.

10. Security and Transparency

An unalterable and transparent ledger of all property-related transactions is maintained on the blockchain. Coupled with blockchain technology's security features, this ensures that the integrity of tokenized real estate investments remains intact.

Pros and Cons of Tokenized Real Estate

The fusion of technology and traditional property investments is embodied by real estate tokenization, which brings its own unique advantages and hurdles:

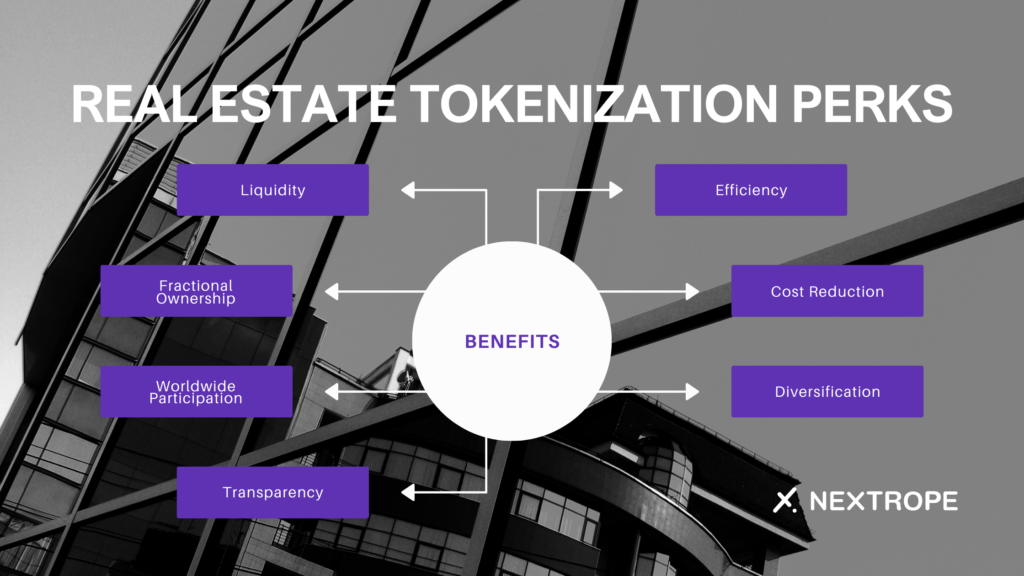

Real Estate Tokenization Perks:

- Liquidity: Tokenization offers enhanced liquidity by allowing investors to trade their tokens on secondary markets, in contrast to the general illiquidity of conventional real estate.

- Fractional Ownership: By breaking properties into smaller units or tokens, multiple investors can partake in property ownership, increasing accessibility to large-scale investments.

- Worldwide Participation: Tokenized real estate reduces border constraints, enabling global investors to put money into properties elsewhere as long as they comply with local regulations.

- Transparency: The blockchain's open ledger guarantees that all transactions are documented, fostering trust among investors.

- Efficiency: Numerous processes are automated via smart contracts, lessening the necessity for intermediaries and expediting transactions.

- Cost Reduction: Fewer intermediaries and automation can result in decreased transaction expenses and management fees.

- Diversification: Without requiring substantial capital expenditures, investors can broaden their portfolios by investing in numerous tokenized properties.

Tokenized Real Estate Challenges:

- Regulatory Ambiguity: Being a novel field, rules surrounding tokenized real estate are still evolving, potentially causing uncertainty for investors.

- Adoption Pace: Traditional investors may be reluctant to embrace this new model due to unfamiliarity or skepticism about blockchain technology.

- Security Worries: Even though blockchain is fundamentally secure, concerns relating to smart contract vulnerabilities or platform hacks might discourage potential investors.

- Market Development: Being a nascent market, tokenized real estate might present limited choices and liquidity for early adopters.

- Integration with Established Systems: Integrating tokenized assets with conventional real estate systems and practices can be intricate.

Small Investors' Benefits from Tokenized Real Estate

Tokenized real estate is creating fresh opportunities particularly for small investors. Here's how:

- Accessible Entry Points: Instead of purchasing an entire property, minor investors can acquire tokens that signify a portion of the property, thus lowering entry barriers.

- Diversified Portfolio: A lower investment threshold makes it more convenient for investors to diversify by acquiring various property tokens or even in distinct geographical regions.

- Liquidity: Tokenized real estate can be traded on secondary markets, facilitating small investors' efforts in cashing out investments compared to traditional real estate.

- Transparency: A public ledger records all token transactions, affording investors a transparent overview of the property's transaction background and fostering trust.

- Decreased Transaction Fees: Blockchain and smart contracts enable a streamlined process, which often results in lower fees, especially advantageous for small investors more sensitive to these expenses.

- Global Possibilities: Small investors are no longer restricted to local markets and can explore worldwide properties that might have been inaccessible due to significant investment minimums or complicated international transactions.

- Return Potential: As with any investment, there's the potential for returns. Tokenized real estate provides small investors the opportunity to grow their investments through property appreciation, rental income distribution, or both.

Potential Risks

- Regulatory Shifts: Investments could be affected by regulatory changes as governments seek to understand the impact of tokenized real estate.

- Vulnerabilities in Smart Contracts: Imperfectly designed smart contracts might contain weaknesses that can be exploited by ill-intentioned individuals.

- Value Volatility: The worth of real estate tokens, like other cryptocurrencies, may be subject to fluctuations.

- Misunderstanding Liquidity: Tokenization provides better liquidity than traditional real estate, but instant liquidity is not guaranteed. Factors such as market maturity, demand, and platform reach will determine the ease with which tokens can be sold.

Conclusion

As real estate and blockchain technology merge, tokenized real estate emerges as a potentially groundbreaking development. Offering transformative benefits such as liquidity, accessibility, and transparency, it also presents novel challenges and risks. Adopting this innovation necessitates a balanced approach, recognizing its limitations while maximizing its potential. As the real estate sector continues to evolve, tokenization may significantly alter our perception and interaction with property investments in the digital era.

en

en  pl

pl