The digital economy is rapidly evolving, and tokenization has risen as an innovative technology with the capacity to transform industries and alter how we perceive and exchange value. As blockchain and cryptocurrencies gain traction, companies are examining new ways to harness tokenization for various assets and services. However, with heightened competition and a saturated marketplace, it is vital for tokenization initiatives to secure a robust presence and achieve visibility among their target demographics.

To accomplish this, public relations and media outreach are instrumental in generating awareness, cultivating trust, and establishing credibility for tokenization projects. By effectively conveying their value proposition and engaging key stakeholders, these initiatives can solidify their market position, entice investors, and foster adoption.

This article will delve into the importance of public relations and media outreach in enhancing the visibility of tokenization projects. We’ll discuss approaches that can assist project teams in navigating the competitive environment while emphasizing the advantages of effective communication in attaining their goals.

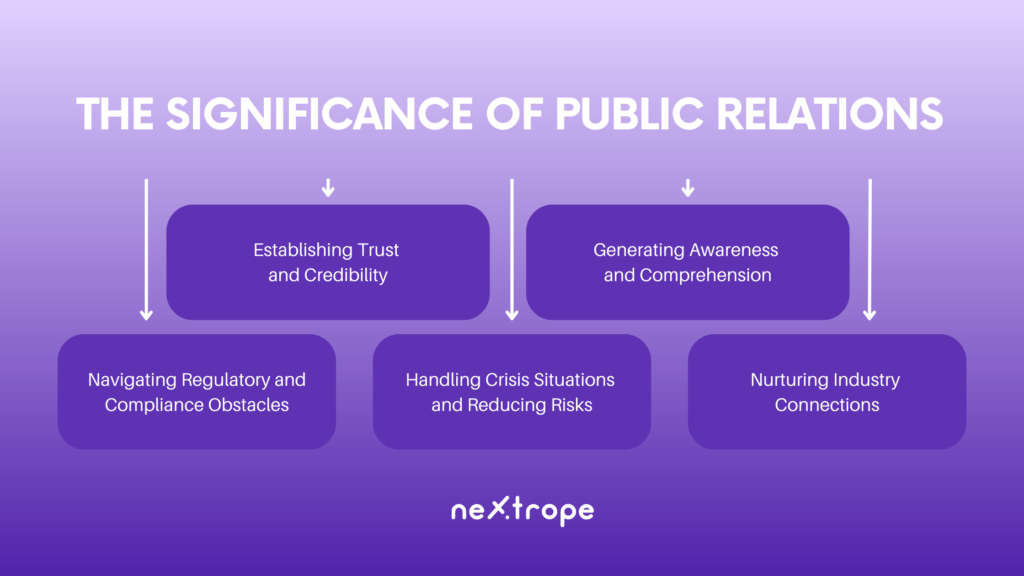

The Significance of Public Relations in Tokenization Projects

In the highly competitive world of tokenization projects, the development of a robust public relations (PR) strategy is essential for attaining success and securing recognition within the industry. Public relations are instrumental in fostering trust, credibility, and awareness for tokenization projects, ultimately influencing their reputation among investors, stakeholders, and the broader public. In this section, the significance of public relations and the unique challenges faced by tokenization projects in achieving widespread acceptance and comprehension will be discussed.

Establishing Trust and Credibility

Due to the relatively new and intricate nature of blockchain technology, potential investors and stakeholders may harbor skepticism and uncertainty about tokenization projects. Through transparent communication and strategic messaging, public relations efforts can alleviate these apprehensions by cultivating trust and credibility. Public relations professionals can bolster confidence and generate a favorable view of the project through successful communication of the project's goals, value proposition, and technical elements.

Generating Awareness and Comprehension

A primary challenge faced by tokenization projects is limited awareness and understanding among the general population. Public relations endeavors have a crucial role in enlightening the target audience regarding tokenization, its advantages, and specific applications associated with the project. By creating clear and straightforward messaging, public relations professionals can demystify complex ideas and ensure that the intended audience grasps the value and potential inherent in the project.

Navigating Regulatory and Compliance Obstacles

The regulatory environment encompassing blockchain technology and cryptocurrencies is not only complicated but also prone to frequent fluctuations. Industry-focused public relations professionals can contribute to tokenization projects by remaining up-to-date on recent regulatory changes, ensuring adherence to regulations, and actively engaging with regulatory entities. Developing strong relationships with regulatory agencies and effectively conveying a project's compliance commitment can help mitigate regulatory risks through public relations efforts while also enhancing the project's credibility.

Handling Crisis Situations and Reducing Risks

During unexpected challenges or crises, public relations serve a vital function in controlling the narrative and minimizing harm to an entity's reputation. With a well-developed crisis communication strategy, tokenization projects can swiftly and effectively react to adverse events, showcasing transparency and responsibility. Public relations specialists can create strategic messages, coordinate with media channels, and address concerns to reduce the effects of crises on the project's standing.

Nurturing Industry Connections

Tokenization projects can benefit from robust relationships with media channels, journalists, influencers, and industry thought leaders. Public relations professionals support the development and maintenance of these connections by actively engaging with pertinent stakeholders, participating in industry conferences and events, and offering valuable insights and thought leadership content. The fostering of such industry relationships enables tokenization projects to capitalize on media exposure, obtain media coverage, and establish themselves as authority figures within the industry.

Tokenization Projects' Media Outreach Strategies

To increase the visibility and success of tokenization projects, the implementation of efficient media outreach strategies is crucial. Utilizing media channels, engaging with journalists, and connecting with influencers enable tokenization projects to access a broader audience, establish credibility, and create a buzz. In this section, we delve into specific media outreach approaches to optimize the project's visibility and influence.

Market Research Implementation and Target Audience Identification

- Recognizing the target audience: Start by performing comprehensive market research to determine the target audience's demographics, interests, and media consumption patterns. This data will direct your media outreach endeavors, making sure you reach the right individuals via suitable channels.

- Spotting relevant media outlets and journalists: Investigate and gather a list of media outlets, publications, blogs, and podcasts that focus on blockchain, cryptocurrencies, and related technologies. Pinpoint journalists and influencers who have expertise in these fields and have a history of reporting on tokenization projects or similar subjects.

Developing an Engaging Story and Key Messages

- Create a distinctive narrative: Design an enticing and unique tale surrounding your tokenization project. Emphasize the issue it intends to address, its value proposition, and its potential impact on industries or individuals. Set your project apart from competitors by accentuating its innovative nature and disruption potential.

- Generate key messages: Condense your project's essential aspects into brief key messages that engage your target audience. These messages should communicate the benefits, applications, and distinctiveness of your project while maintaining consistency across all communication channels.

Establishing Connections with Media Outlets and Journalists

- Participate in industry conferences and events: Attend pertinent industry conferences, meetups, and gatherings where you can interact with reporters, influencers, and industry professionals. Building in-person relationships can result in valuable media exposure opportunities.

- Offer exclusive content and interviews: Present journalists and media channels with exclusive updates, specialist interviews, and thought leadership pieces related to your project. This fosters a sense of uniqueness and entices them to showcase your project, boosting its visibility.

Using Press Releases and Thought Leadership Content

- Press releases: Develop well-crafted and informative press releases that announce significant project milestones, collaborations, product releases, or essential updates. Distribute these press releases via trustworthy wire services and target industry-focused media outlets.

- Thought leadership content: Generate stimulating content like whitepapers, research reports, blog articles, or opinion essays. Position yourself or core team members as thought leaders in the tokenization field by offering valuable insights and analyses. Share this content through your blog, guest posts on relevant publications, or social media platforms.

Exploiting Social Media and Influencers

- Maintain an active social media presence: Be regularly present on social media platforms popular within the blockchain and cryptocurrency communities. Share project updates, thought leadership content, and interact with followers, industry influencers, and potential investors. Utilize pertinent hashtags and participate in meaningful discussions to widen your reach.

- Partner with influencers: Identify influential individuals in the blockchain and cryptocurrency sector who have a substantial following and connect with your target audience. Team up with these influencers via sponsored content, interviews, or co-sponsored events. Their support and promotion of your project can greatly boost visibility and trustworthiness.

Implementing these media outreach techniques allows tokenization projects to effectively enhance their visibility, draw media attention, and spark interest among their target audience. Continuously monitoring and evaluating the impact of these strategies is essential, making adjustments as needed to optimize media outreach initiatives.

Conclusion

In the realm of tokenization projects where competition is intense, impactful media outreach is crucial to increase exposure, build reliability, and encourage adoption. By gauging the accomplishments of their media outreach endeavors and adjusting tactics using data-driven insights, tokenization projects can fine-tune their communication initiatives for maximum results. Continuous assessment of messaging, engaging suitable media platforms and influencers, and refining the overall approach will set tokenization projects on a course for achieving long-term triumph within the ever-changing blockchain and cryptocurrency environment.

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a two months and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

en

en  pl

pl