Through digital tokens on a blockchain, tokenization represents real-world assets or rights, and its rapid adoption is anticipated to influence the future of multiple industries. This groundbreaking technology has the capacity to transform how we invest, conduct transactions, and engage with assets.

It is vital to examine current trends in tokenization for 2023 and beyond as these advances unfold. Grasping the market size and possible financial implications, as well as the challenges and opportunities that come with tokenization will aid businesses and individuals in successfully navigating this transformative environment.

Key Aspects Shaping the Future of Tokenization

Traditional Asset Tokenization

Fractional Ownership Possibilities: The ability to divide assets into smaller units through tokenization permits fractional ownership. This broadens investment opportunities and makes them more accessible to a wider range of investors.

Liquidity Enhancement. By tokenizing traditional assets such as real estate, artworks, and intellectual property, liquidity can be unlocked, allowing for fractional trading. This leads to increased market efficiency and provides investors with expanded liquidity options.

Securities Tokens and Regulatory Compliance

Fundraising Approach Disruption: Compliant security tokens (STOs) serve as alternatives to conventional fundraising methods like initial public offerings (IPOs), leading to increased transparency, reduced intermediaries, and automated compliance – ultimately making capital markets more efficient and accessible.

Regulatory Compliance and Safeguarding Investors: To guarantee investor protection and legal compliance, tokenization calls for solid regulatory frameworks. Adoption of clear guidelines and standards for security tokens and their issuance will promote trust in tokenized assets.

Applications of Decentralized Finance (DeFi)

Innovations in Financial Products. The growth of decentralized finance (DeFi) applications is propelled by tokenization, which leverages blockchain technology and smart contracts to create new financial products and services. DeFi platforms facilitate lending, borrowing, and trading with improved efficiency, accessibility, and programmability.

Financial Services Democratization: By eliminating intermediaries, DeFi applications offer access to financial services for underserved communities, promoting financial inclusion while giving individuals more control over their financial assets and transactions.

Data Privacy Enhancement & Self-Sovereign Identities

Data Privacy Improvement. Individual data privacy can be improved through tokenization, enabling individuals to tokenize their personal information and have more control over data sharing decisions.

Self-Sovereign Identity Development: Tokenization contributes to the creation of self-sovereign identity solutions. Tokenized identity attributes allow for secure authentication and streamlined identity verification processes while maintaining control over personal data.

Interoperability & Standardization

Effortless Token Transfer: With the expansion of tokenization, interoperability between various blockchains and tokenization protocols will be essential. Implementing these interoperability standards will facilitate the seamless transfer and exchange of tokens among different platforms, ultimately promoting an efficient, connected tokenized ecosystem.

Tokenization Protocol Standardization: Industry standardization of tokenization protocols enhances compatibility, boosts efficiency, and encourages wider adoption. Standardized protocols foster interoperability, allowing various platforms to recognize and utilize tokens.

These essential factors will guide the development of tokenization in the future, propelling its expansion and transforming industries by increasing liquidity, assisting with regulatory compliance, encouraging decentralized finance innovation, improving data privacy, and fostering interoperability.

Market Size and Projections

As the tokenization market undergoes considerable growth, it is anticipated to continue expanding in the next few years. Numerous reports and analyses reveal the present market size and future projections, which are based on tokenization adoption and potential.

Growth of the Tokenization Market

Markets & Markets' report discloses that in 2021, the tokenization market was worth approximately $2.3 billion. With an average annual growth rate of 19%, it is predicted to attain a value of $5.6 billion by 2025.

Positive Projections

- Tokenized Assets Possibly in Trillions by 2030:

Analysts and experts in the industry have an optimistic outlook on tokenized assets' potential. By 2030, they anticipate that the volume of tokenized assets could be within the trillion-dollar range.

- Security Token Trading Volumes:

In 2021, security tokens reached trading volumes of around $4.1 trillion. Forecasts suggest that by 2030, these volumes could skyrocket to $162.7 trillion. The significant growth can be ascribed to the rising adoption of tokens across various sectors, such as music, fashion, retail, sports, film, etc.

- Predicted Global NFT Market Value:

Considerable growth is expected in the non-fungible token (NFT) market, a specific type of tokenization for unique digital assets. The global NFT market value projected to reach $231 billion by 2030.

- Tokenized Security Assets Comprising 10% of Global GDP:

By 2030, Boston Consulting Group anticipates that around 10% of global Gross Domestic Product (GDP) could be represented by tokenized security assets. This prediction underscores the potential influence of tokenization on the conventional securities market.

It is crucial to recognize that these estimates are dependent on various factors and market forces. Actual growth and market size might differ depending on adoption rates, regulatory changes, technological innovations, and market trends.

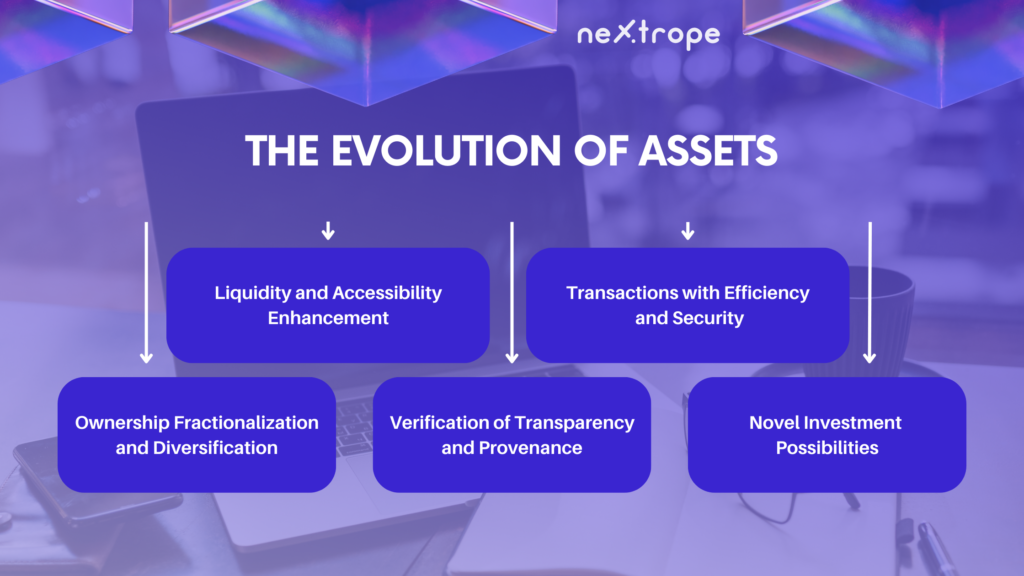

The Evolution of Assets

The anticipated impact of asset tokenization is a transformation in asset management, investment, and transactions. The future of assets lies in the development of inventive business models enabled by the decentralized nature of Distributed Ledger Technology (DLT) and blockchain.

Liquidity and Accessibility Enhancement

Capital Unlocked. Significant amounts of capital, currently trapped in illiquid assets within conventional systems, have the potential to be unlocked through tokenization. The process enhances liquidity by fractionating assets and enabling easy transferability, thus expanding investment possibilities for more participants.

Barrier Reduction: Tokenization reduces entry barriers for traditionally hard-to-reach assets. Retail investors now have access to assets such as real estate, artworks, or intellectual property with smaller investments, fostering financial inclusivity and democratizing investment opportunities.

Transactions with Efficiency and Security

Simplified Transaction Processes: Tokenization leads to faster, more efficient transaction processes. By utilizing decentralized networks, participants can complete asset transactions within minutes, decreasing dependence on intermediaries and eliminating manual paperwork.

Cost Efficiency: Tokenization reduces transaction costs in terms of both time and money. Distributed architecture-facilitated automated processes decrease administrative overheads and optimize asset transfers and ownership, resulting in cost savings for all involved parties.

Ownership Fractionalization and Diversification

Opportunities for Diversification: Tokenization offers investors more chances to diversify their holdings. They can effortlessly invest in fractions of numerous assets, effectively diversifying their portfolios and managing risk.

Fractionalized Ownership: Tokenization allows multiple investors to obtain fractional ownership of an asset. This model promotes inclusivity and enables smaller investors to participate in markets that were previously inaccessible.

Verification of Transparency and Provenance

Improved Transparency. Asset transaction transparency bolstered by tokenization. Blockchain technology guarantees that transaction records are unalterable and easily auditable, which increases trust and minimizes fraud potential.

Provenance Tracking: Tokenization permits the monitoring of an asset's provenance throughout its existence. This capability is especially significant for assets like artworks and luxury items, where verifying authenticity and ownership history is essential.

Novel Investment Possibilities

Groundbreaking Business Models: Tokenization lays the groundwork for cutting-edge business models that capitalize on the advantages of blockchain technology. These models encompass peer-to-peer lending platforms, decentralized marketplaces, and innovative investment instruments, giving investors a wider array of investment opportunities.

New Asset Classes: Tokenization goes beyond traditional assets to spawn new asset classes. Digital assets, such as virtual real estate, digital art, and in-game items, could become valuable investment opportunities in the future.

It is worth noting that adapting and evolving regulatory frameworks will be necessary for the future of assets to accommodate technological advancements. Policymakers and regulators hold a critical role in developing suitable safeguards and ensuring investor protection as well as overall economic stability in this changing tokenized environment.

Challenges and Solutions for the Future

Tokenization shows immense potential for revolutionizing a variety of industries. However, it faces hurdles that must be addressed to allow for widespread adoption and success. Some future challenges and their possible resolutions include:

Frameworks for Regulation

Challenge: A continually developing regulatory landscape exists for tokenization, necessitating well-defined and all-encompassing regulations to guarantee investor safety and maintain market integrity.

Solution: To develop regulatory frameworks that balance innovation with risk reduction, policymakers should cooperate with industry experts. These frameworks ought to offer clarity on compliance prerequisites, security benchmarks, and legal responsibilities.

Standards and Interoperability

Challenge: Hindered by the absence of universally accepted tokenization standards and a lack of interoperability between blockchains, the smooth transfer and exchange of tokens is inhibited.

Solution: Establishing interoperability protocols and tokenization standards through industry collaborations and standardization endeavors can enable compatibility and connectivity across diverse platforms, nurturing a more effective and interconnected tokenized environment.

Privacy and Security

Challenge: Tokenization's decentralized nature presents new risks to security and privacy, such as unauthorized access to personal data, data breaches, and hacking.

Solution: To safeguard user data and tokenized assets, strong cybersecurity measures—including encryption techniques, identity management solutions, and secure smart contract development—must be employed. Privacy-preserving technologies like zero-knowledge proofs can facilitate selective disclosure of personal information while retaining privacy.

Technical Infrastructure and Scalability

Challenge: As tokenization gains popularity, challenges may arise related to handling a high volume of transactions and maintaining efficiency in blockchain networks.

Solution: Research and development on layer 2 protocols, sidechains, sharding, and other blockchain scalability solutions can address these scalability issues. Furthermore, tokenized systems will grow and scale alongside advances in blockchain technology and infrastructure.

Conclusion - Future of Tokenization

Tokenization stands on the brink of revolutionizing various sectors through unlocking liquidity, amplifying accessibility, and simplifying asset transactions. While the future of tokenization brims with potential, it concurrently poses hurdles such as regulatory frameworks, interoperability, security, privacy, and scalability. The partnership among all stakeholders proves crucial in forging a lasting and all-encompassing tokenized ecosystem that enriches individuals, enterprises, and the worldwide economy. Tokenization is clearing the path for an invigorating period of asset administration and investment possibilities.

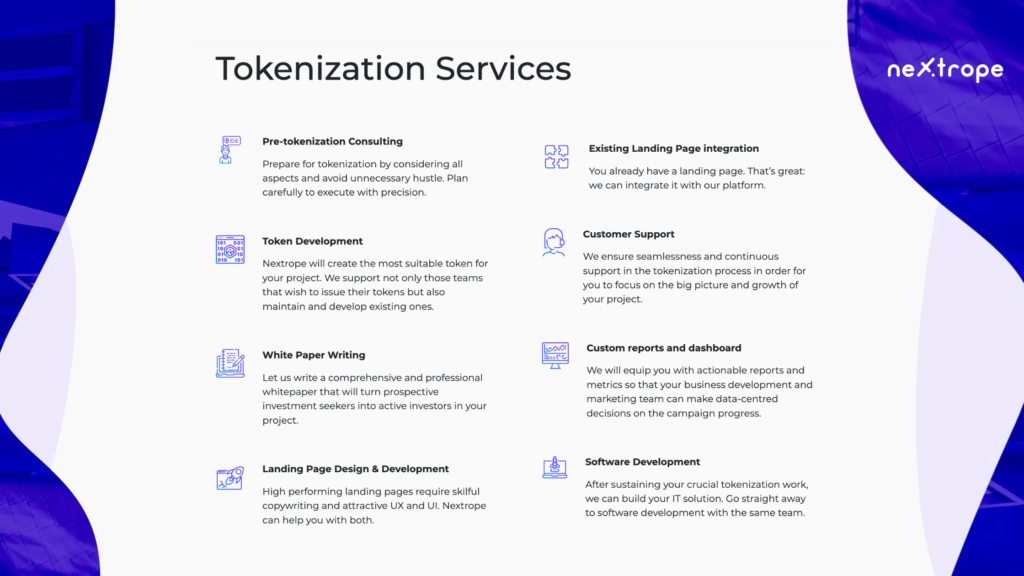

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a month and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

Our platform allows you to participate in the broad financial market of digital assets. Expand your reach and find investors globally. Tokenize your project and start raising capital within a month!

en

en  pl

pl