Web 3's arrival has significantly transformed our interaction with technology by introducing a user-focused, decentralized approach to online experiences. Central to Web 3 projects is the demand for efficient communication and community engagement, which social media platforms have effectively addressed. Among these platforms, Twitter has become a critical component of the Web 3 environment by facilitating smooth communication, fostering community development, and promoting the adoption of cryptocurrencies and blockchain technology.

In this article, we will explore the significant role of Twitter in Web 3 projects. We will delve into the ways Twitter serves as a communication channel, fosters community building and engagement, and contributes to influencer marketing and thought leadership in the Web 3 space. Furthermore, we will examine Twitter's impact on crypto and blockchain adoption, including its role in providing news and market updates, announcing token launches and airdrops, and influencing market sentiment.

Twitter's Influence in Web 3 Projects

Twitter as a Communication Channel

Twitter serves as a powerful communication channel within Web 3 projects, facilitating real-time and decentralized information exchange. Its concise and immediate nature makes it ideal for sharing updates, announcements, and insights related to blockchain, AI, and cryptocurrencies.

- Real-time Updates: Twitter's fast-paced nature allows project teams and community members to share and receive instant updates on Web 3 developments, including project milestones, partnerships, and technical advancements.

- Decentralized Platform: Twitter's decentralized nature aligns with the principles of Web 3, where power and control are distributed. It provides a level playing field for communication, enabling anyone to participate and contribute to the discourse.

- Fluid Information Exchange: Twitter's brevity and simplicity encourage concise discussions and the sharing of valuable resources. Threads and replies allow for in-depth conversations, fostering a dynamic and fluid exchange of ideas.

Community Building and Engagement

Twitter plays a vital role in community building and engagement for Web 3 projects, providing a platform for like-minded individuals to connect, share knowledge, and collaborate.

- Hashtags and Mentions: Twitter's use of hashtags allows users to tag relevant keywords, making it easier to discover and engage with specific Web 3 topics. Mentions enable direct communication and networking with project teams, influencers, and thought leaders.

- Polls, Threads, and Spaces: Twitter's features like polls enable community members to express opinions and gather feedback. Threads facilitate the organization of complex discussions, while Spaces provide an interactive audio experience for hosting live conversations and AMAs (Ask Me Anything) sessions.

- Networking Opportunities: Twitter serves as a virtual gathering place for Web 3 enthusiasts, developers, investors, and industry professionals. Engaging in discussions and following influential voices can lead to valuable connections and collaboration opportunities.

Influencer Marketing and Thought Leadership

Twitter has become a hub for influential figures and thought leaders in the Web 3 space, shaping opinions and driving conversations around blockchain, AI, and cryptocurrencies.

- Influence on Project Perception: Influencers on Twitter possess the ability to amplify the reach and visibility of Web 3 projects. Their endorsements, opinions, and insights can significantly impact project perception, attracting attention from potential users, investors, and partners.

- Knowledge Sharing and Education: Influencers and thought leaders often share educational content, tutorials, and resources on Twitter, making it a valuable platform for learning about Web 3 technologies and their potential applications.

Twitter's influence in Web 3 projects extends beyond communication and community engagement. In the next section, we will explore its role in driving crypto and blockchain adoption, providing news and market updates, and influencing market sentiment.

Twitter's Role in Crypto and Blockchain Adoption

News and Market Updates

Twitter plays a significant role in providing real-time news and market updates within the crypto and blockchain industry. It serves as a valuable source of information for investors, enthusiasts, and project teams.

- Timely Information Dissemination: Twitter's fast-paced nature allows for the immediate sharing of news related to cryptocurrencies, blockchain technology, regulatory developments, and market trends. Users can follow relevant accounts and hashtags to stay informed about the latest updates.

- Breaking News and Announcements: Twitter often becomes the go-to platform for project teams and industry leaders to make important announcements. Token listings, partnerships, product launches, and regulatory decisions are often first revealed on Twitter, providing real-time updates to the community.

Token Announcements and Airdrops

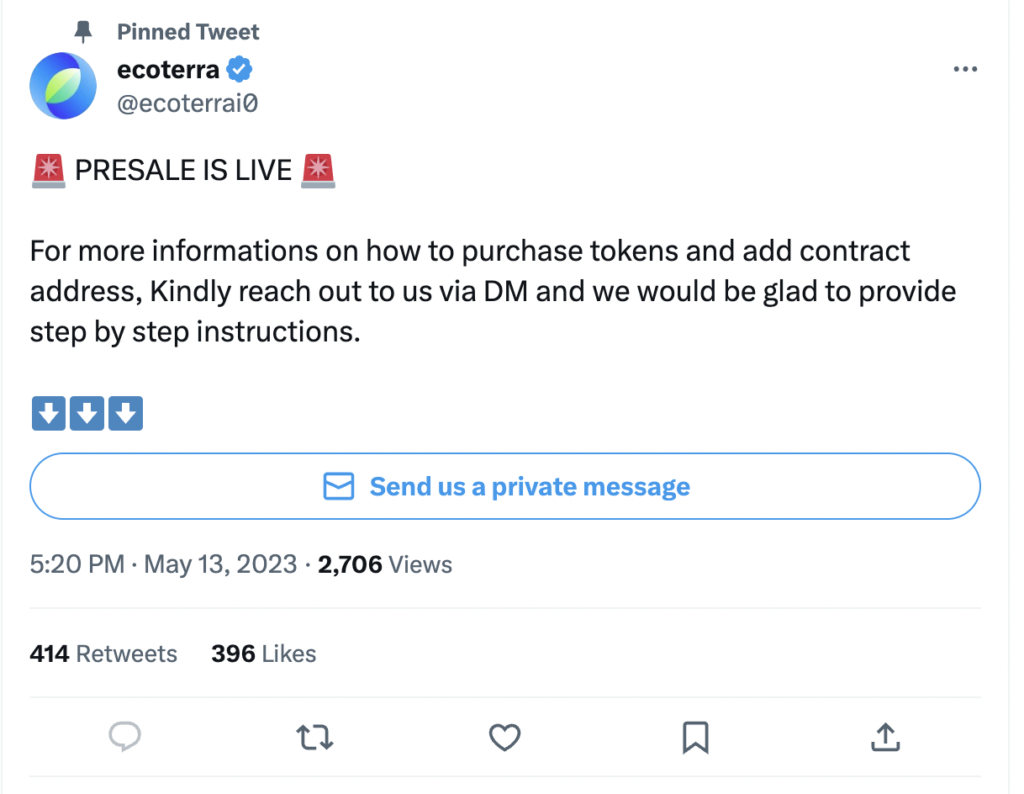

Twitter serves as a platform for token announcements and airdrops, creating opportunities for crypto projects to engage with their communities and distribute tokens.

- Token Launches: Many projects utilize Twitter to announce token launches, providing details about token distribution, tokenomics, and token sale events. This enables projects to reach a wide audience and generate interest in their tokens.

- Airdrop Campaigns: Airdrops, where free tokens are distributed to community members, are often promoted and coordinated through Twitter. This approach helps projects bootstrap their communities, increase token adoption, and generate awareness.

Influencing Market Sentiment

Twitter has a significant impact on shaping market sentiment and influencing cryptocurrency prices. Tweets from influential figures can create both positive and negative effects on the market.

- Influencer Effect. Influential individuals, including prominent industry figures and celebrities, have the power to sway market sentiment through their tweets. Positive endorsements or negative remarks can lead to increased buying or selling activity, affecting cryptocurrency prices.

- Market Analysis and Predictions. Twitter serves as a platform for experts and analysts to share their market analysis, price predictions, and trading strategies. These insights contribute to market sentiment and influence investor decisions.

- Trend Identification. Twitter's trending topics and hashtags provide valuable insights into the most discussed cryptocurrencies, blockchain projects, and market trends. Monitoring these trends can help investors stay informed and identify potential investment opportunities.

Twitter's role in crypto and blockchain adoption extends beyond communication and community engagement. In the next section, we will address challenges and considerations associated with using Twitter for Web 3 projects.

Challenges and Considerations in Using Twitter for Web 3 Projects

While Twitter offers significant benefits for Web 3 projects, there are also challenges and considerations that project teams should be aware of. These factors can impact the effectiveness and sustainability of utilizing Twitter as a communication and engagement platform.

Censorship and Centralization Concerns

- Centralized Platform

- Content Moderation

Building Resilient Communities

- Dependency Risk

- Decentralized Alternatives

By understanding these challenges and considerations, Web 3 projects can develop strategies to overcome them. And eventually: build resilient communities that are not solely reliant on Twitter. This ensures the long-term sustainability and independence of their communication and engagement efforts.

Conclusion

In Web 3 projects, Twitter holds a crucial position. It is a potent communication medium that promotes community formation, engagement, and the adoption of cryptocurrency and blockchain technology. Through real-time updates and fostering connections between individuals with similar interests, Twitter sets the stage for industry leaders to guide discussions. Nonetheless, obstacles such as censorship and centralization issues emphasize the importance of creating strong communities for Web 3 projects and investigating decentralized options. By capitalizing on Twitter's advantages while keeping these concerns in mind, Web 3 initiatives can efficiently utilize the platform to flourish within the decentralized tech sphere. Acknowledge Twitter's significant impact on Web 3 and employ it as an instrument for growth and involvement in the ecosystem.

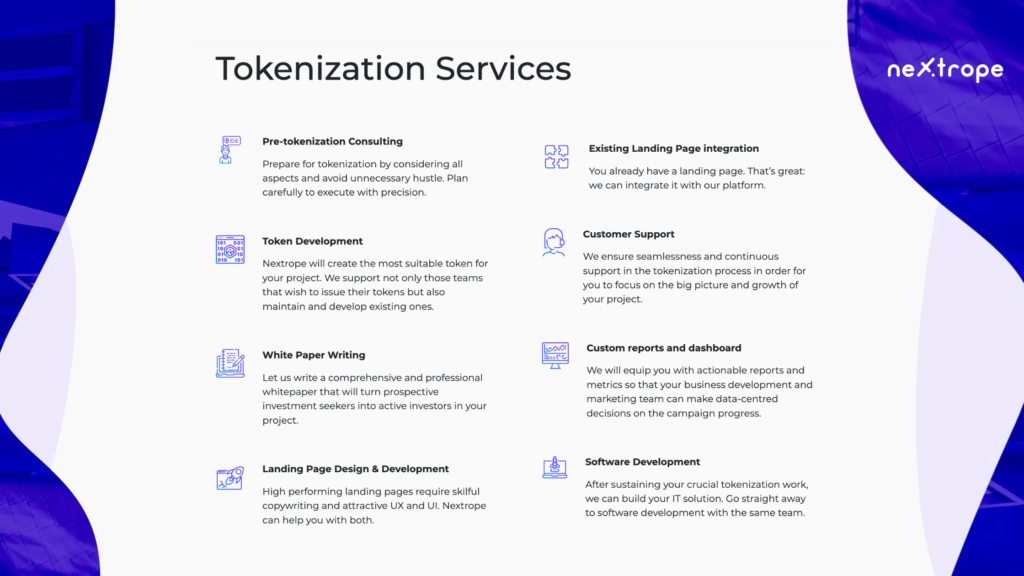

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a month and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

Our platform allows you to participate in the broad financial market of digital assets. Expand your reach and find investors globally. Tokenize your project and start raising capital within a month!

en

en  pl

pl