Tokenization, the process of turning a range of assets into digital tokens on a blockchain network, has proven to be a powerful instrument that transforms industries such as real estate, finance and supply chain management. By augmenting liquidity, facilitating fractional ownership and promoting transparency and safety, it has been a game changer. Though, the success of such tokenization projects hinges largely on effective content marketing approaches.

In this article, we will delve into the prime practices and advice for content marketing curated particularly for tokenization projects. This write-up intends to provide you with useful knowledge needed to effectively promote your tokenization project via content, regardless of whether you are blockchain-based startup exploring tokenization or a service provider in the blockchain realm.

- Significance of Content Marketing in Tokenization Projects

- Superior Strategies for Content Marketing in Tokenization Initiatives

- Tips for Effective Content Marketing in Tokenization Projects

- Increase your reach with collaboration with insiders and thought-leaders

- Incorporate engaging visuals and interactive formats in your content

- Evaluate performance metrics for refining your strategy

- Keep pace with industry evolution, provide timely updates

- Customizing content according to buyer's persona boosts engagement rates

- Conclusion

- Nextrope Tokenization Launchpad Platform

Significance of Content Marketing in Tokenization Projects

Content marketing is central to propelling and ensuring the success of tokenization projects. It serves multiple functions like educating the target audience, building reputable trust and credibility and generating leads for conversions. Let's dissect each of these roles:

Audience Education

The field of tokenization is relatively uncharted territory where several prospective investors and stakeholders may lack comprehensive understanding about it's practices and benefits. Content marketing fills this knowledge void by offering educational resources.

Crafting informative blog posts:

To educate audiences, write recurring blogs that outline basic principles of tokenization, its benefits and practical cases in an understandable manner while avoiding technical terminology.

Creating detailed whitepapers:

Whitepapers are reliable documents offering deep insights into technicalities of tokenization. Constructing whitepapers that narrate technology aspects, token economics and legal factors can exhibit your prowess in this field along with providing valuable data to potential investors.

Making explainer video content:

Due to their engaging nature, videos are excellent succinct tools for explaining complex themes. Therefore, crafting explainer videos that visually depict the process and advantages of tokenization along with real-world instances can educate a larger audience effectively.

Trust and Credibility Enhancement

Tokenization endeavours often require investors confidence and trust in the project team which content marketing can help build and bolster through:

Success stories & case studies:

By publishing positive outcomes from prior tokenization projects through practical case studies, potential investors gain confidence. Such real-life examples demonstrate the effectiveness of tokenization acting as direct proof for your venture.

Thought Leadership Pieces:

By positioning your team as thought leaders via insightful articles you can elevate your project's status within the industry steadily. Publishing assessments, analyses or futuristic concepts helps create an image of a trustworthy authority within the industry.

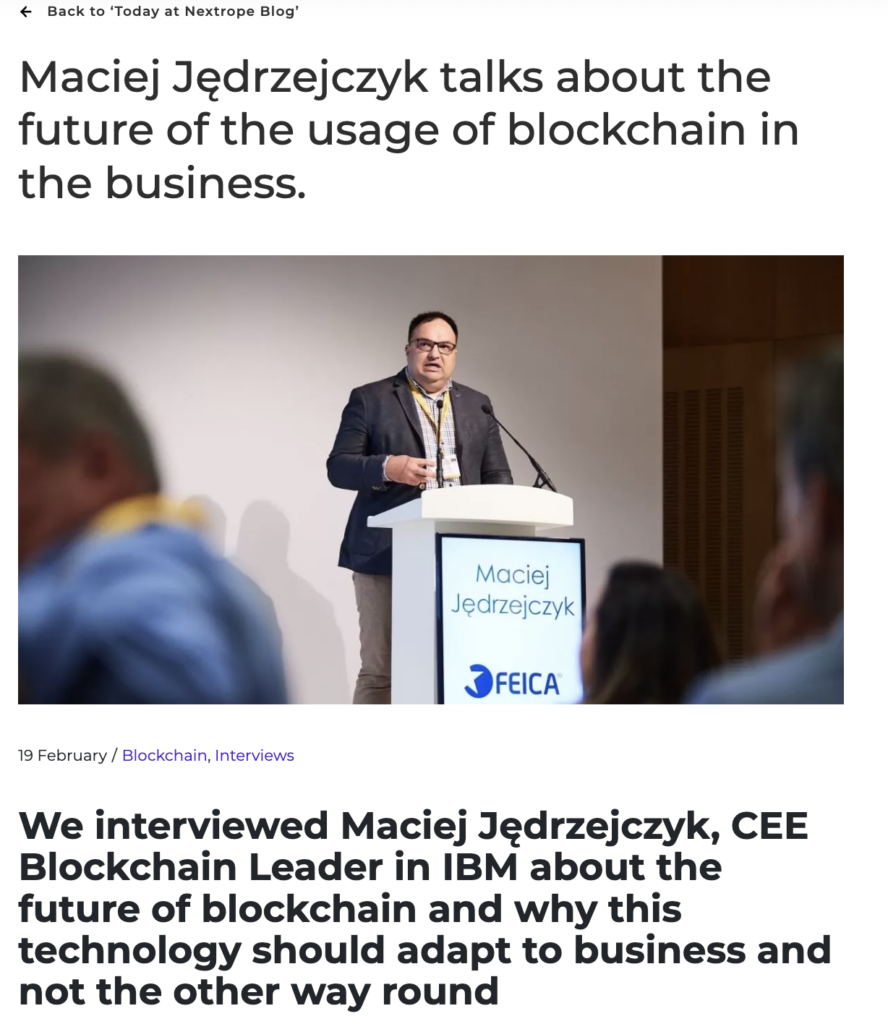

Conducting Expert Interviews & Opinions Sharing:

When you conduct interviews with industry professionals sharing their views on topics relating to tokenization it lends more credibility to your content. Featuring well-known industry figures allows you to utilize their expertise and popularity towards creating a credible image.

Check out our Interviews! - with Maciej Jędrzejczyk, CEE Blockchain Leader in IBM and Muffie Fulton, Sr. Director of Pharma Solutions at Chronicled

Facilitating Lead Generation & Conversion Catalysts

Efficient content marketing approaches can help in generating leads who can be turned into active contributors or investors in your project through methods like:

Optimizing Call-to-action (CTA) :

Incorporate definitive CTAs that persuasively compel readers to execute specific actions like newsletter subscription, guide download or an update sign up within your content. CTA optimization is effective in capturing leads, pushing them further within conversion funnel.

Creating & Optimizing Landing Pages:

Create specific landing pages carrying targeted information about your project serving as conversion spots. Optimized pages with convincing writing style, visually pleasing design along with lead capture forms enhance chances of conversions greatly.

Superior Strategies for Content Marketing in Tokenization Initiatives

Boosting the effect and efficiency of your tokenization project strategy relies on the execution of content marketing best practices. These guidelines help in building a robust foundation that captures the attention and engages your target audience. Below are some exceptional practices to keep in mind:

Analysis of the target audience

A comprehensive understanding of your target audience is fundamental before formulating your content marketing strategy. It assists you in the creation of content that aligns with your audience's needs, thereby escalating its significance and influence, by identifying their demographic data, interests, problems, and preferences through detailed research and analysis.

Formulating a content strategy

An explicit content strategy governs your marketing efforts providing uniformity across different channels. Keep these steps in mind while shaping your content strategy.

1. Establish definite objectives:

Decide on clear measurable targets for your marketing initiative. Are you looking at raising brand recognition, achieving more leads, educating consumers, or pushing for conversions? These specifically defined aims ensure that your content lines up with expected results.

2. Identify Key Performance Indicators (KPIs):

Integrate KPIs that match your goals which can comprise website visits, engagement metrics, conversion rates for leads, email opening rates, or social media metrics. Continuous surveillance and examination of these KPIs help in evaluating the productivity of your content marketing strategy.

3. Arrange a content calendar:

Design a scheduler for planning and orchestrating content formation and distribution which should cover topics, formats, and publishing timelines for your material. A well-managed calendar ensures regularity while also facilitating strategic planning.

Crafting quality engaging material

The quality impinges on the success of your content marketing endeavors along with its resonance with consumers. Here are some tips to create intriguingly enriching material:

1. Creation of informative articles:

Commit time and resources to thoroughly research topics ensuring accurate, timely information offering valuable insights or actionable data to consumers enhancing credibility while positioning you as a trusted resource.

2. Utilize visual aids like infographics and pictures:

Engaging visual concepts effectively presents complex ideas while making it highly appealing enhancing readership ultimately increasing it’s sharing potential

3. Incorporate storytelling methods:

Stories deliver substantial emotional impact capturing audiences’ attention while presenting benefits aiding them towards overcoming their challenges invoking inspirations based on real-world examples or narratives

Encourage community engagement via social media

Recognizing appropriate social media platforms maximizing presence thereby fostering relationships instigating interactions absorbing feedback answering queries inviting consumer contributions further leverages additional values while boosting overall engagement

Continually employing these superior strategies continually reassessing based on analytics lifting visibility engaging audiences effectively benefiting tokenization initiatives enhancing achievements

Read more about social media in tokenization project here

Tips for Effective Content Marketing in Tokenization Projects

To take your content marketing strategy for tokenization projects to the next level, consider implementing the following tips. These tips will help you maximize the impact of your content and drive better results.

Increase your reach with collaboration with insiders and thought-leaders

Joining forces with thought-leaders and insiders can notably expand both the reach and credibility of your content. Here are some strategies you can adopt:

1. Interview related pros: Converse with acclaimed pros in tokenization and blockchain space maintaining the value of your content by providing different insights and perspectives.

2. Cobrand content creation: Encourage thought-leaders to participate in co-branding webinars, podcasts or add guest posts. Their participation can magnetize their followers expanding your reach.

3. Ask for positive reviews: Display testimonials from discussed professionals or influencers with a good impression of your tokenization project on your website, aiding increased trust and credibility.

Incorporate engaging visuals and interactive formats in your content

Introduction of interactive and visual elements helps seize your audience's attention while improving engagement rate.

1. Use visual summaries or infographics: Display complex information as easy-to-understand visuals, making it easier to communicate.

2. Develop calculators or interactive tools: Craft tools that provide estimates of potential returns or aid understanding token economics.

3. Utilize animations or video formats: Exploit the usage of videos showcasing use cases, explaining concepts or highlighting the benefits of your project.

Evaluate performance metrics for refining your strategy

It's vital to analyze data periodically for enhancing your marketing efforts continually.

1. Keep track of important metrics: Using analytics tools monitor vital metrics like website traffic, conversion rates etc.

2. Test various aspects through A/B testing: Check different variations of headlines, CTAs for identifying what resonates well with the audience.

3. Active listening to audience feedback: Pay heed to feedback through surveys or social media interactions allowing you to modify your content strategy accordingly.

Keep pace with industry evolution, provide timely updates

Aligning content with latest industry trends helps maintain relevance which entices audience attention:

1. Keep an eye on latest updates: Staying informed about trending issues enables content addressing challenges and opportunities.

2. Provide analytical insights: Furnishing audience valuable insights helps build a loyal following.

3. Focus on educating the community on newer concepts: Creating tutorials aids brand positioning as a dependable resource in acquiring knowledge about industry happenings.

Customizing content according to buyer's persona boosts engagement rates

1. Segmenting market: Categorising market based on parameters such as demography helps create specific content targeting those segments.

2. Develop targeted solutions: Formulate content focusing on personal challenges and goals.

3. Automation in marketing: Implement automated tools delivering personalised user experiences based on user behaviour.

Conclusion

The driving force behind the success of tokenization projects is undeniably content marketing. Pursuing best practices and adhering to the provided advice can lead to a robust content strategy that can not only educate your audience but also build trust and generate leads. Keys for capturing the attention of your target audience include personalization, joining forces with influencers and utilizing visual and interactive content. Staying in tune with the industry trends, analyzing performance metrics, and constantly fine-tuning your content marketing techniques can fuel the progress and acceptance of your tokenization project. This approach consequently attracts investors and stakeholders, thus marking a substantial influence on the blockchain industry.

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a month and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

Our platform allows you to participate in the broad financial market of digital assets. Expand your reach and find investors globally. Tokenize your project and start raising capital within a month!

en

en  pl

pl