As the world continues to swiftly adapt to blockchain technology, artificial intelligence, and cryptocurrency, the innovative idea of tokenization has come forward with the potential to profoundly transform various sectors. Tokenization involves representing tangible assets or rights within the digital realm via tokens on a blockchain. In order to effectively capitalize on tokenization's advantages, businesses must implement strong marketing campaigns that generate awareness, entice investors, and encourage widespread adoption.

Nonetheless, initiating a successful tokenization marketing campaign is merely the beginning. Companies need to assess their campaigns' success to gauge the efficacy of their tactics, refine future endeavors, and substantiate their worth to stakeholders. In this article, we aim to offer an exhaustive evaluation of critical metrics and key performance indicators (KPIs) that can be employed to determine a tokenization marketing campaign's success.

Throughout this article, various essential metrics and KPIs will be discussed in detail so as to assess the effectiveness of tokenization marketing campaigns. We will cover a range of indicators, from reach and engagement metrics to conversion rates and social media analytics.

Essential Metrics for Evaluating the Effectiveness of a Tokenization Marketing Campaign

It is crucial to thoroughly examine essential metrics to determine the success of a tokenization marketing campaign. By monitoring and evaluating these metrics, businesses can determine their campaign's reach, engagement, conversion, influence on social media, and content performance. The following are the critical metrics to be considered when evaluating a tokenization marketing campaign's success:

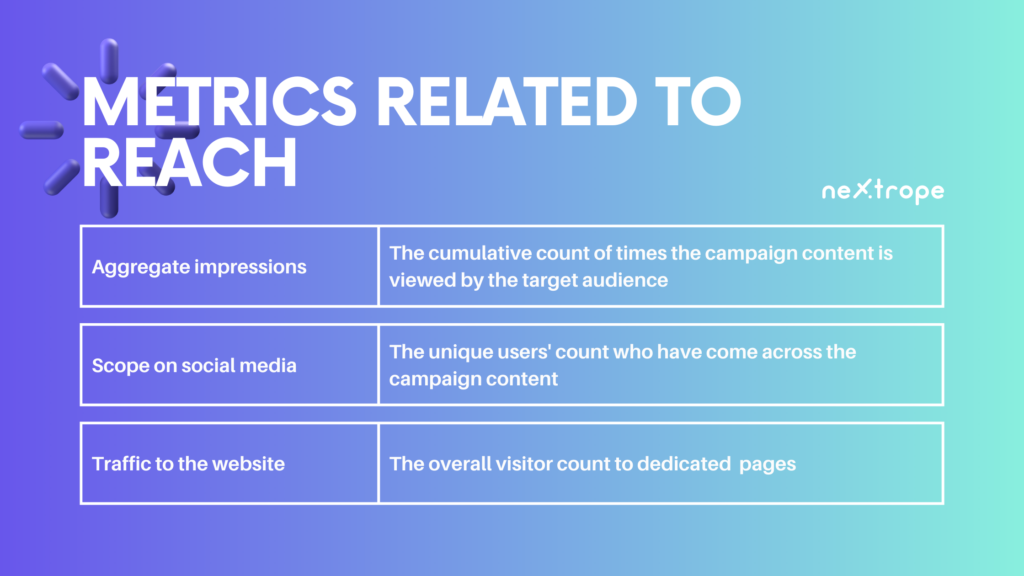

Metrics Related to Reach

1. Aggregate impressions. The cumulative count of times the campaign content is viewed by the target audience through numerous channels like social media, websites, and advertising platforms.

2. Scope on social media. The unique users' count who have come across the campaign content on various social media platforms provides insights into visibility and possible audience size.

3. Traffic to the website. The overall visitor count to dedicated landing pages or websites for the campaign helps assess how effective it is in driving traffic and capturing interest.

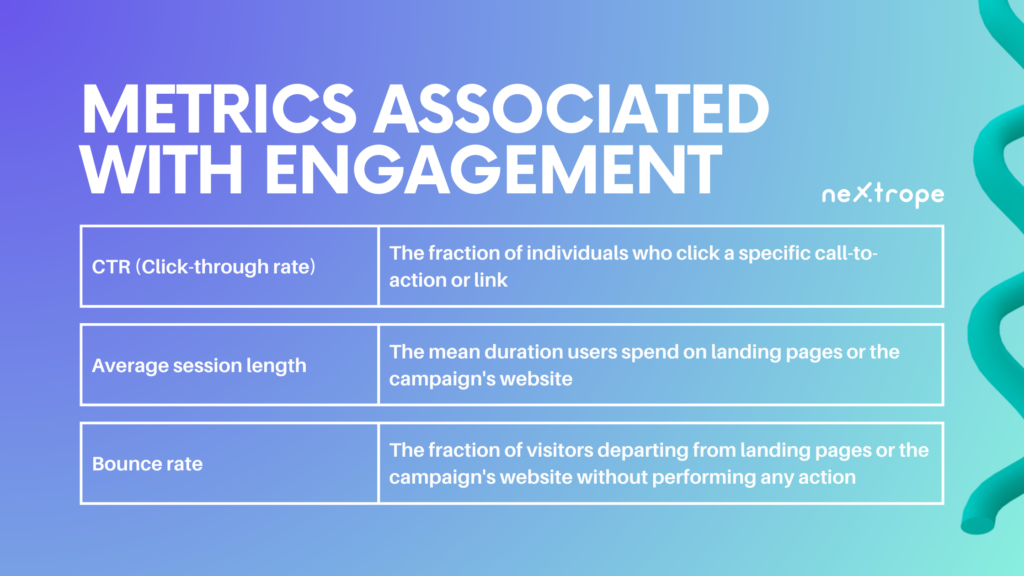

Metrics Associated with Engagement

1. CTR (Click-through rate). The fraction of individuals who click a specific call-to-action or link within the campaign content gauges how effective it is in generating interest and encouraging engagement.

2. Average session length. The mean duration users spend on landing pages or the campaign's website indicates their engagement level and interest in the campaign.

3. Bounce rate. The fraction of visitors departing from landing pages or the campaign's website without performing any action implies issues with relevance or compelling content when higher.

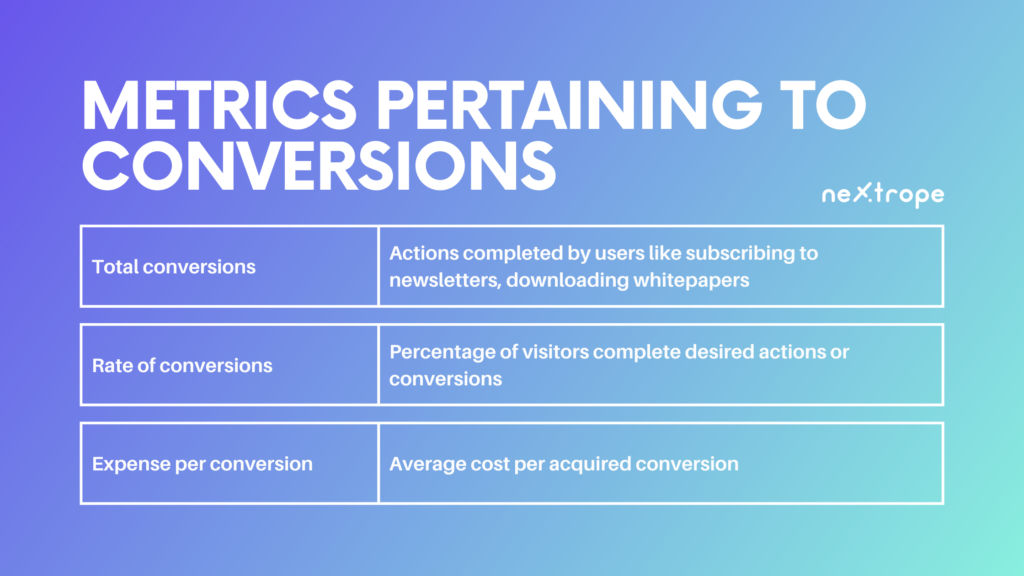

Metrics Pertaining to Conversions

1. Total conversions. Actions completed by users like subscribing to newsletters, downloading whitepapers, or making purchases indicate a campaign's capability in driving desired results.

2. Rate of conversions. A higher rate showing what percentage of visitors complete desired actions or conversions reflects a more effective campaign in persuading users.

3. Expense per conversion. Tracking average cost per acquired conversion assists in measuring campaign efficiency and cost-effectiveness for generating desired outcomes.

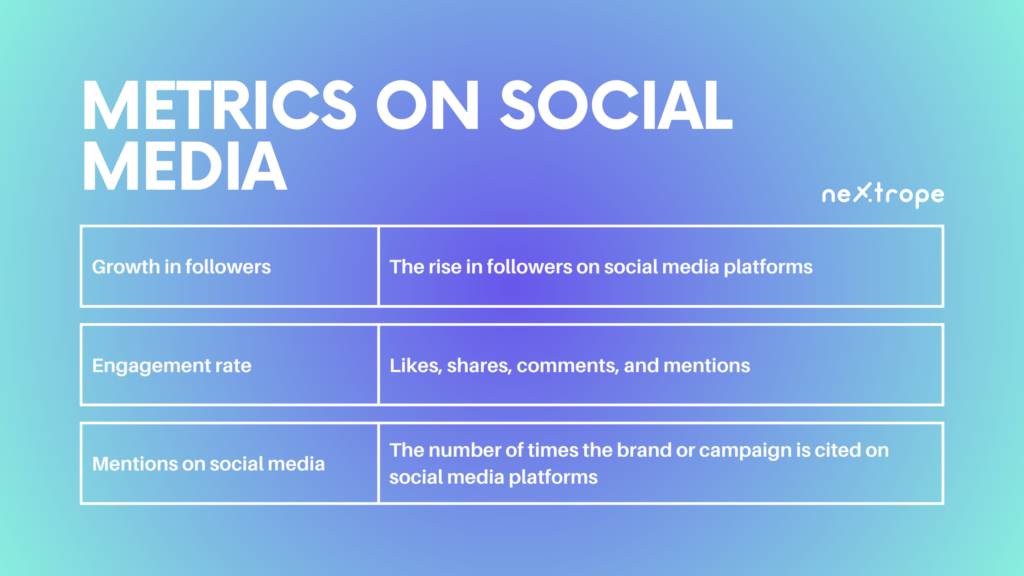

Metrics on Social Media

1. Growth in followers. The rise in followers on social media platforms during a campaign serves as a testament to its ability to appeal and engage audiences.

2. Engagement rate. Measuring user interactions with campaign content on social media platforms, such as likes, shares, comments, and mentions, demonstrates the campaign's success in resonating with audiences.

3. Mentions on social media. The number of times the brand or campaign is cited on social media platforms indicates its visibility, reach, and impact on respective channels.

Read our article about Leveraging Social Media

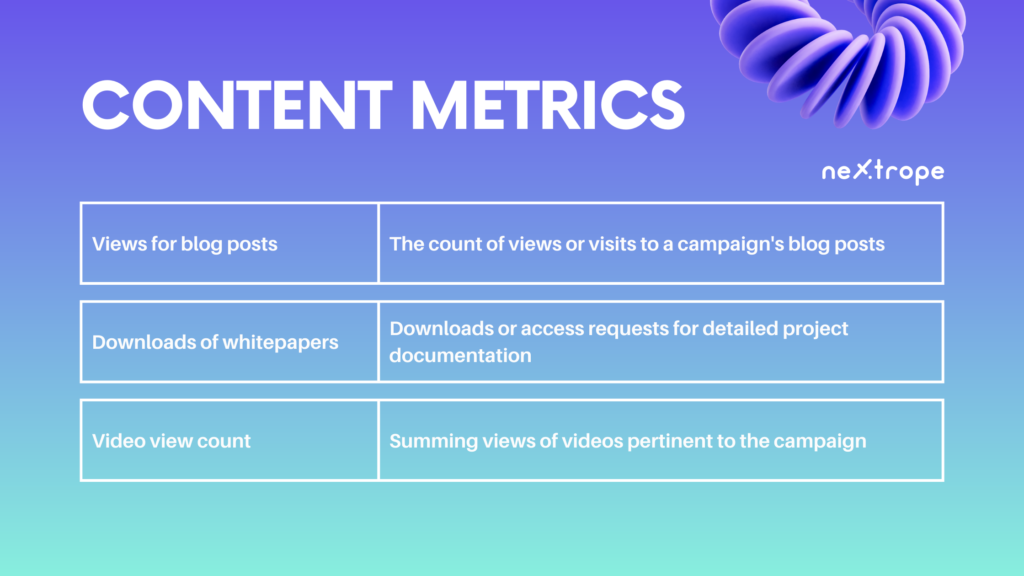

Content Metrics

1. Views for blog posts. The count of views or visits to a campaign's blog posts helps evaluate engagement and interest among potential investors or stakeholders.

2. Downloads of whitepapers. Quantifying downloads or access requests for detailed project documentation offers insights into a campaign's potential for generating interest from investors or stakeholders.

3. Video view count. Summing views of videos pertinent to the campaign reflects success in capturing audience curiosity and engagement.

By closely examining these crucial metrics, businesses can extract valuable information regarding their tokenization marketing campaigns' performance and effectiveness. Utilizing quantifiable data benefits decision-making, tactical optimization, and achieving objectives for the campaign.

Essential Key Performance Indicators (KPIs) for Evaluating the Effectiveness of a Tokenization Marketing Campaign

Key metrics offer specific data points to gauge the performance of a tokenization marketing campaign, whereas key performance indicators (KPIs) deliver a more comprehensive understanding of the campaign's overall effectiveness. KPIs enable the assessment of the campaign's influence on key business goals and supply valuable insights for informed strategic decisions. The following KPIs should be considered when evaluating the success of a tokenization marketing campaign:

Expansion in Token Holders

1. Quantity of new token holders. The aggregate number of new individuals or organizations that obtain and possess the token throughout the campaign. This demonstrates the campaign's capacity to attract new investors and broaden the token holder foundation.

2. Growth percentage of token holders. The percentage at which the number of token holders rises within a particular time frame. This demonstrates the campaign's competency in promoting adoption and enlarging the token's user base.

Market Capitalization

1. Overall market capitalization. The combined value of all tokens circulating during the campaign, arrived at by multiplying token price with total supply. It represents market value and general perception of the token.

2. Market capitalization growth rate. The percent increase in market capitalization for tokens over a specific period. This highlights the campaign's abilities to stimulate demand, elevate token value, and captivate investors.

Brand Awareness

1. Brand references in media. The frequency with which news articles, blogs, interviews, or other media platforms allude to the campaign or brand. This symbolizes the campaign's contributions toward elevating brand visibility and awareness.

2. Favorable sentiment in media coverage. The portion of media citations that express a positive perspective regarding the campaign or brand. It signifies the campaign’s efficacy in creating an agreeable public opinion.

Investor Confidence

1. Number of alliances or collaborations. The count of strategic alliances or collaborations formed during the campaign. This proves the campaign's capability to foster trust, draw respected partners, and boost investor confidence.

2. Increase in investment inquiries. The percentage growth in potential investors' inquiries or expressions of interest from institutions. This highlights the campaign's proficiency in seizing investor attention and producing investment prospects.

By scrutinizing these key performance indicators, companies can evaluate the overall success and impact of their tokenization marketing campaigns. These KPIs offer a comprehensive perspective on the campaign's performance, aligning with business targets such as investor growth, trading activity, market perception, brand visibility, and investor confidence. Utilizing these insights, businesses can fine-tune their strategies, pinpoint areas requiring enhancement, and achieve sustained success within the tokenization ecosystem.

Conclusion

It is essential for businesses aspiring to excel in the blockchain, AI, and cryptocurrency sectors to measure the success of their tokenization marketing campaigns. Assessing the reach, engagement, conversion, social media influence, and overall performance of campaigns can be achieved by employing key metrics and key performance indicators (KPIs).

Valuable insights into campaign effectiveness can be obtained by examining metrics such as impressions, conversion rates, mentions on social media, and website traffic. Furthermore, KPIs like token holder growth, trading volume, market capitalization, brand awareness, and investor confidence offer a comprehensive understanding of the campaign's influence on vital business objectives.

en

en  pl

pl