We have already covered the tokenization of companies and real estate extensively on the blog. We can also apply similar solutions to alternative assets. Why does it even make sense to tokenize cars, works of art or wine?

The need for portfolio diversification and the comfort that comes with owning uncorrelated assets are nothing new in the investment world. But it is in times of market stress that their role becomes particularly important. Just look at last summer’s record gold price. Alternative assets, however, have far more faces than just metals and precious stones. Cars, art or exclusive liquors not only satisfy people’s whims, but can also turn out to be a safe deposit of funds and even bring profits from investments. Why is it worth tokenising them?

Tokenisation of cars

Exotic cars have played an important role in the world of digital content for years. However, anyone who thinks that their only use is to highlight the owner’s status is mistaken. Research shows that they can be an extremely worthy investment alternative. According to a Knight Frank report, investment in vintage cars returned over 330% in the 10 years to 2017. Far outperforming other alternative assets such as diamonds, jewellery and art in this regard. However, for obvious reasons, not everyone can afford it. Such a car remains simply too expensive for most. But what if we could only acquire part of it?

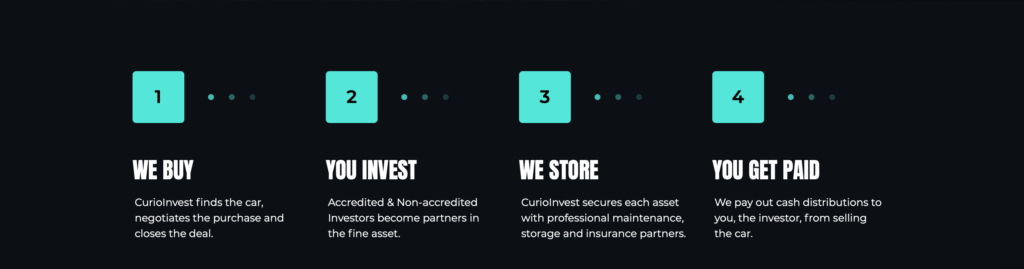

CT1, which is the result of a collaboration between investment platform CurioInvest and digital asset exchange MERJ Exchange, is one of the latest tokens whose value is secured by collector cars. According to both companies, it is the tokenization of luxury goods that will make them accessible to a wider range of investors.

” If we look at works of art or collector cars we see that they have historically been seen as safe havens for investment, ” says Fernando Verboonen, founder and CEO of CurioInvest. ” Today they are held by very few. By introducing new technology, we are enabling everyone to fully benefit from the features and functions that define this asset class as a whole.”

An investment for everyone

Last year, companies released 1.1 million tokens secured by the $1.1 million Ferarri F12TDF CTI. For less than 4 zlotys we could become shareholders in a supercar worth almost 4 million, whose value in the coming years will probably only increase. The project assumes tokenization of as many as 500 collector cars with a total value of over 200 million dollars. The machines are to be stored and maintained in a garage owned by CurioInvest in Stuttgart. When buying tokens, we do not have to worry about their transport or maintenance.

Currently, one of the main problems in the secondary sale of exotic cars is the multitude of diverse and complex price models. Often, due to the lack of standardisation and regional differences, no one is able to determine how much a model is really worth. By harnessing the potential of blockchain technology, tokenization will allow the current market value to be adjusted in real time. This will create a number of new opportunities and simplifications, especially in the insurance industry, where it is necessary to accurately determine the value of a car.

Art

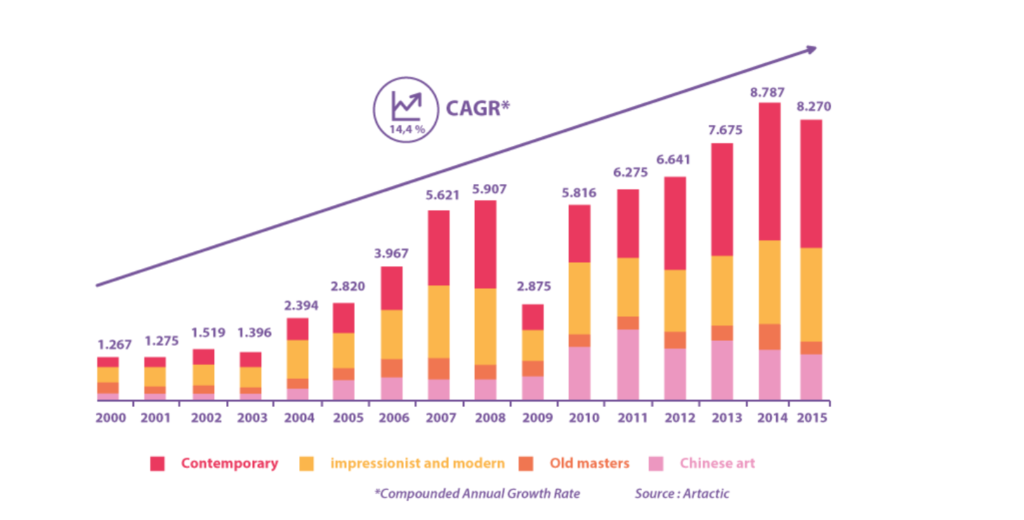

In 2018, sales on the global art market reached $67 billion. Which represents an increase of 6.3% over 2017 and 12% over 2016. For years, post-war and contemporary art has remained the most important sector in terms of value. Over the past 20 years, works from these periods have produced a compound annual return (CAR) that exceeds the S&P’s total return by 10.7%. However, the growing art market remains highly illiquid and, like collector cars, accessible only to a limited number of wealthy individuals and institutions.

Several token projects have recently emerged that seek to change this. The first of these, Maecenas, in 2018 began tokenizing artworks by launching the groundbreaking work of American pop art pioneer Andy Warhol – ’14 Little Electric Chairs’. By basing the sale on blockchain, it was able to attract hundreds of investors previously unconnected to the art world, helping to increase the valuation of the work from $1.7 million to $5.6 million.

Tokenization significantly increases the liquidity of investment in art – we are trading tokens, only “part” of the work, so we do not have to look for a buyer for the whole. It can also bring numerous benefits to the artist himself. If the artist decides to tokenize his work, he will both earn from the sale of part of the tokens and retain a stake in the whole, allowing him to profit from the increase in value of his work.

Tokenisation of collector wines

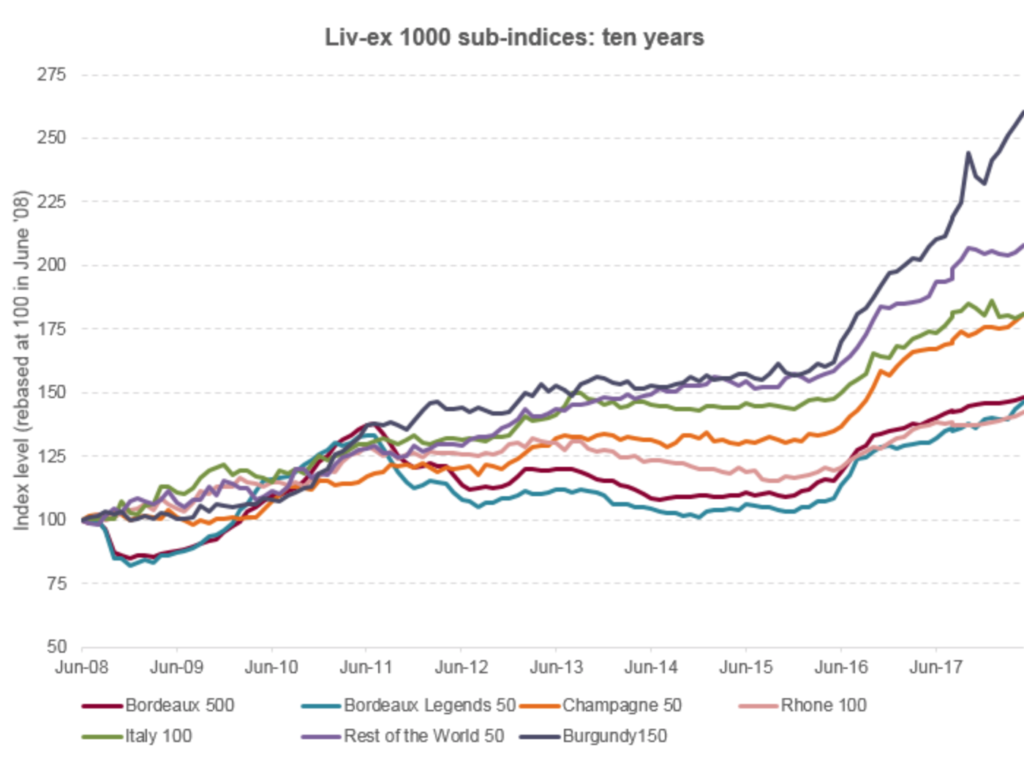

Investing in wine for the uninitiated may sound like a weak joke. Nothing could be further from the truth. Collectible wines, as investment assets, are characterised by a high rate of return and significant resistance to economic fluctuations. While the truthfulness of the statement that the older the wine the better is limited – once it reaches full maturity, the quality starts to decrease, there is no doubt that the price of rare examples increases over time.

There are a number of factors that guarantee the constancy of this trend. First of all, connoisseurs consider the grape harvest vintage as a factor defining the characteristics of individual bottles, and this vintage is unique – there will not be another 1945 or 2010.

The growing value of the land on which grapes are grown is also of no small importance. The average price of a hectare of vineyard in the famous Champagne exceeds 1 million euros, which is still a modest amount compared to the 15 million you have to pay for the best Grand Cru in Burgundy. Often, within just one hilltop, there are several parcels with different growing conditions. The differences between them may seem insignificant to the layman, but to the connoisseur they are often colossal. For example, the fruit for the auction record-breaking Domaine de la Romanée-Conti La Romanée Conticomes from a plot of just 1.81 hectares. Demand for rare wines continues to grow (largely due to growing interest in China) while the number of prestigious plots is limited and fixed.

In addition, ongoing climate change and the associated rise in temperature are forcing winemakers in particular regions (e.g. Bordeaux) to change their production processes and even the style of their finished products, potentially increasing the value of older vintages.

Does good wine have to be expensive?

When it comes to wines that have investment potential this statement is unfortunately completely true. Only about 5% of the wines produced are suitable for ageing, and among these only a small proportion is of real interest to collectors. Of course, it pays to invest not only in the most expensive labels. A few hundred dollars for a bottle of wine, whose price may increase even 4 times over time, does not necessarily sound like an insurmountable barrier for the average investor. It should be remembered, however, that such wine cannot simply be placed on a shelf and wait until its market value increases. Proper storage is key. Temperature, humidity and even lighting – all these determine whether the beverage will actually mature over time and acquire new qualities, or simply spoil.

Unfortunately, the prices of specialised refrigerators, suitable for storing collectible wines, start at several thousand dollars. Buying and maintaining such equipment with only one bottle in mind simply does not make sense. Not everyone has enough space at their disposal, either. Moreover, wine trading, due to numerous legal restrictions (wine is, after all, an alcoholic beverage), is rarely conducted in the peer-to-peer model, which significantly complicates the matter of its sale by an independent investor. As a result, investments in wine collectors, despite numerous advantages, remain so far closed to a narrow group of people and institutions. As in the case of antique cars and art, this problem can be solved with tokenization.

Tokens as a breakthrough for the industry

When buying tokens whose value would be secured by wine, we would not have to worry about storing the bottles. They would be kept in refrigerators or entire special cellars of the token distributor, just like cars in the garages of the aforementioned CurioInvest. Furthermore, tokenization would significantly increase liquidity in the collectible wine market. When buying wine in the traditional way, we in a way freeze our funds. It often takes years for the value of wine to rise, and even when we decide to liquidate our investments, we have no guarantee that we will find a buyer for our bottle right away. Tokens would be free from such restrictions, we could sell them at any time, without worrying about the cost and risk of transport (bottles are made of glass!) or looking for someone willing to buy the whole wine.

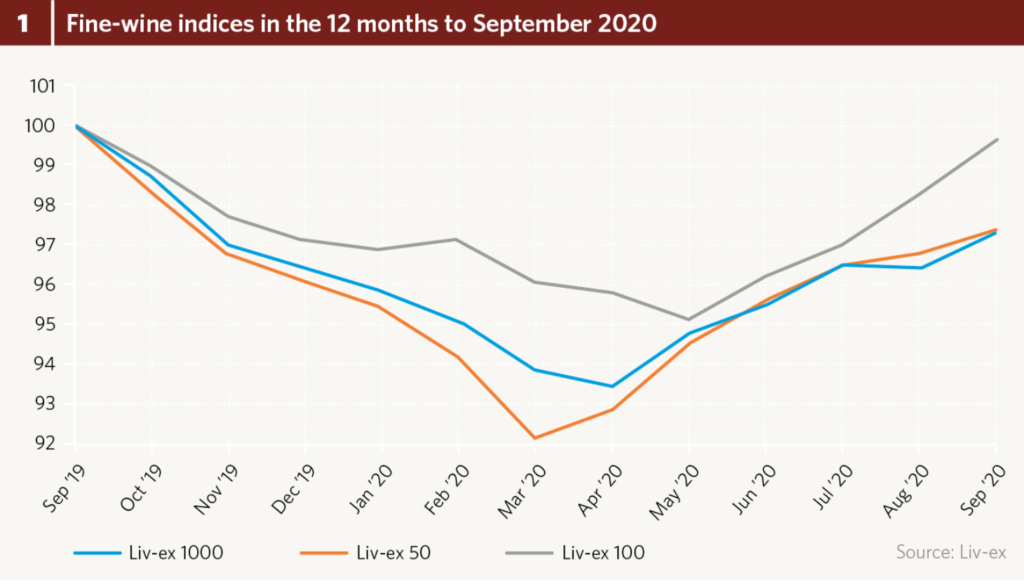

Projects distributing such tokens are already emerging. One of them is Vinsent, which, thanks to tokenization, makes it possible to buy cases of wine while it is still in the initial stages of production. The market for exclusive wine during a coronavirus pandemic is characterised by much lower volatility than global stock markets. And as this coincides with a renewed interest in blockchain technology we can expect more similar projects to emerge in the near future.

Where will the tokenization of alternative assets take us?

The tokenization of cars, art or wine does not sound so exotic if we look at already existing projects that have taken even less typical assets for a spin. Take SardineCoin, for example, a token offered by Luxembourg-based MY Sardines, whose value is secured by tinned sardines. The company is banking on the durability and ease of storage of the canned fish, which it says can last for hundreds of years as a collector’s item. All indications are that all the possible uses of this technology will be explored for a long time to come. Of course, not every tokenization idea is doomed to success. Not only the characteristics of the assets themselves, but above all the quality of the technological solutions used have a determining influence on the end result.

Do you have your own idea for a tokenization project? Get in touch with our team of experts who will certainly be able to help you.