What is DeFi? In what ways is it better than traditional financial solutions?

DeFi stands for "decentralized finance". It is an umbrella term used to describe the various financial applications of Blockchain technology aimed at pushing financial intermediaries away. Blockchain allows multiple entities to store copies of transaction history, removing it from the control of one central source. This is what decentralization means.

What is the difference in practice? When you pay by credit card for purchases, financial intermediaries such as your bank or Visa or Mastercard mediate in the transaction between you and the seller, having the right to stop it and register it in their private ledger. With DeFi these institutions disappear.

So what is the advantage of DeFi over traditional solutions?

Advantages of DeFi

Blockchain = safety

The use of Blockchain Solution technology provides a new level of transparency and security. In DeFi, every user can see where their digital assets are stored and how they are used. Transaction-securing smart contracts, once implemented, are permanently recorded and cannot be changed. In practice, this means that transactions are only executed if both parties comply with the terms of the contract.

Exclusive control in the hands of users

Most banks are quickly adapting to the online world, tempting users with new applications or solutions to facilitate transactions such as the Polish Blik. However, the money on user accounts is still under the control of the bank. In this respect DeFi is far ahead. Only the owner has the private key to his decentralized wallet and only he has control over the funds stored there.

Democratization of development

Changes in traditional finance take up to decades, and all decisions from the user's perspective are made behind closed doors. In DeFi, innovations are made in real time, and the development itself reflects the idea of democratizing finance. In DeFi, there are no permissions specifying who can introduce new code to the network, so theoretically it is possible for anyone to do so. Moreover, users of the solutions are often involved in the process of voting on changes.

High return on investment

Traditional banks for the public will continue to be the best place to deposit funds for a long time to come. But in fact, why? After all, interest rates are lowered more and more every year, and fees remain the same.

In contrast, DeFi financially incentivizes users to bet or borrow assets. The interest that would have gone to the bank when borrowing the customer's money is paid directly to the lender. So with DeFi, the user earns interest that is usually retained by the bank.

DeFi Loans

In fact, in the beginning, all lending was peer-to-peer. People lent funds to each other based on more or less forced trust. For obvious reasons, this arrangement was high risk for the lender. Banks have solved the problems with credit trust, but have added additional costs and levels of regulation.

Crypto lending allows for a return to a peer-to-peer model. They significantly reduce costs by removing intermediaries while providing complete transaction security.

DeFi allows peer-to-peer lending to exist directly tailored to borrowers and lenders. Typically, a crypto loan is secured by a smart contract and cryptocurrency assets. The interest rate, on the other hand, is based on the value of the funds that the borrower uses as collateral. The loan can be made in both cryptocurrencies and fiat currencies.

Support for small entrepreneurs

Lending to small and medium-sized entrepreneurs is one of the most important aspects of traditional finance that needs to change. They are the ones who most often struggle to get funding. Crypto loans are a way to make it significantly easier for them.

The key factor to obtaining such a loan is the amount of cryptocurrency funds that the borrower is able to put up as collateral. Due to the volatility of cryptocurrencies, loans are very much collateral. In practice, this means that they require a collateral ratio of at least 150%, which provides lenders with some safeguards in managing risk. In contrast, traditional creditworthiness is not considered in the evaluation process.

An example of a solution that provides such support to entrepreneurs is Amplify, which additionally combines another plus of cryptocurrency lending: 24-hour availability.

DeFi – what next?

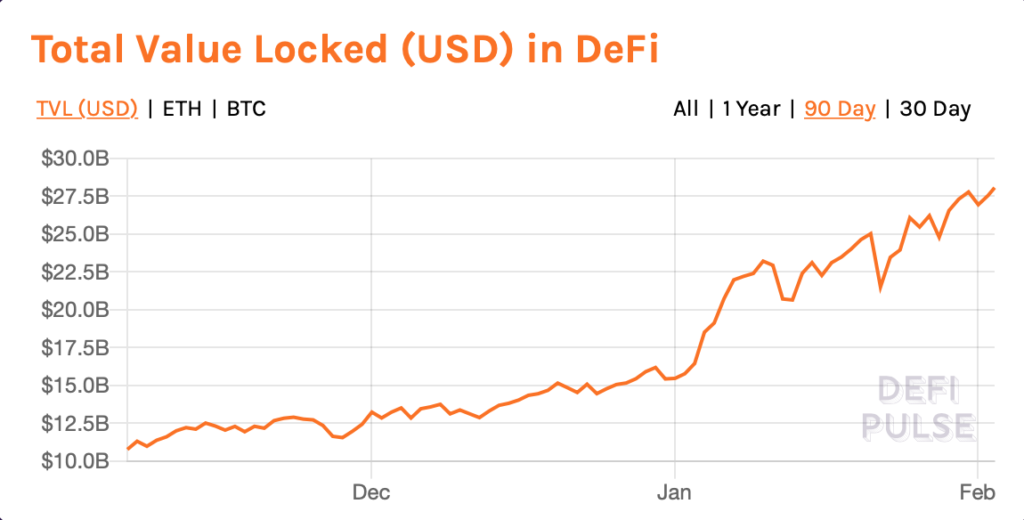

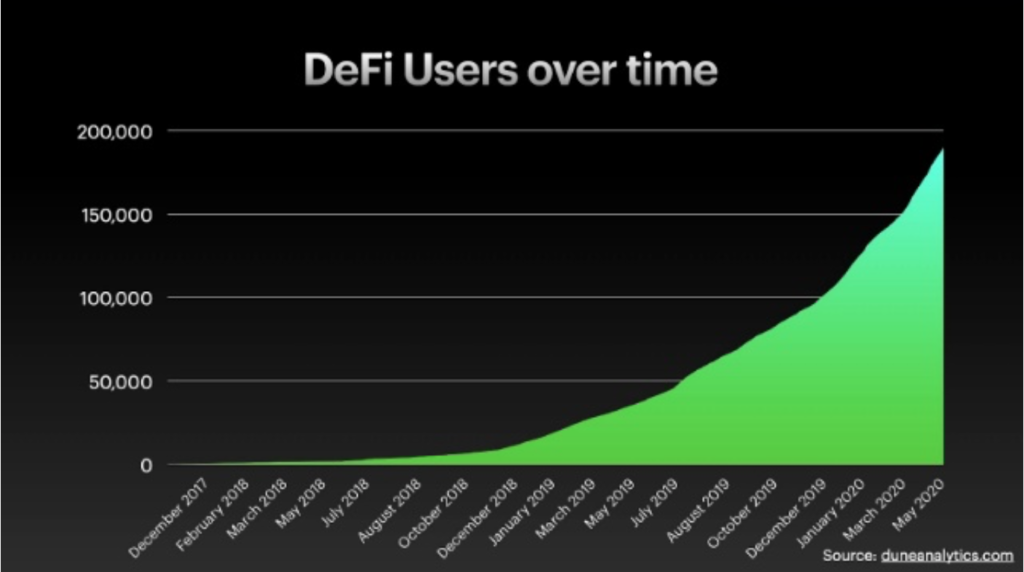

Although DeFi has been on the market for only a short time, it is already a viable alternative to many financial services that have been out there for decades. The growing popularity of DeFi shows that users all over the world want to increase control over their finances and start defining the terms on which they use the services.

Do you have an idea for a DeFi project? Get in touch with our experts who know exactly how to help you realize it.

en

en  pl

pl