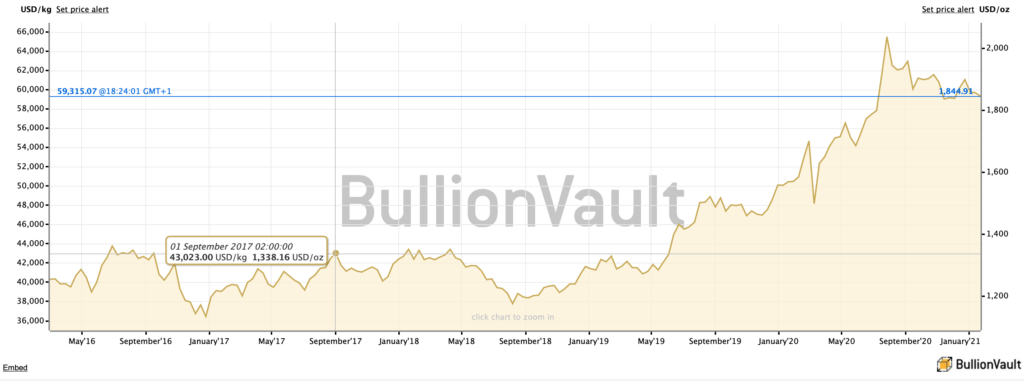

Last year, the price of gold broke through historic highs pulling in increased investment in other precious metals as well. Given the very good forecasts for the current year, we discuss why it is time to tokenize them.

Both gold and silver have been popular investments for thousands of years. Currently, precious metals are finding more and more industrial and investment applications, while the scale of their extraction still remains relatively limited. As their value increases, so does the degree and dynamics of Blockchain technology development. There are many indications that tokenization of precious metals may become one of its most significant applications.

Tokenization of precious metals - why it makes sense?

Precious metal-backed tokens can be traded continuously and globally, making them far more liquid than virtually any other form of precious metal ownership. They are also easier to store securely and do not carry the risk of theft associated with physical storage of the metal by the purchaser.

Because tokens are created using blockchain technology they are traded in a decentralised manner. This means that no person or institution can influence the process of buying and selling them if it does not comply with the established rules. Furthermore, the nature of decentralised markets forces the entity issuing the tokens to follow best practices, such as transparent auditing and safekeeping of the assets backing the tokens. The buyer of tokens therefore has virtually direct access to the assets held without the need for physical storage.

Tokenization of precious metals = security

It is security that is the greatest asset of this decentralisation. At present, the precious metals market is not free of scams and uncertainties. The recent case of JP Morgan, which is under criminal investigation for manipulating silver prices, is a clear illustration of this. The decentralisation of the precious metals market is capable of providing a new level of transparency in transactions. Yet it is the lack of this that is responsible for most of the theft, fraud and manipulation associated with traditional markets.

Silver tokenization

Silver Cryptocoin is a Danish company that wanted to allow investors a more convenient way to buy and store silver. To this end, it relied on tokenization. Instead of buying physical silver, an investor can buy its digital equivalent on the Ethereum blockchain. The resulting ERC20 token is fully backed by bullion safely stored by the company. The investor can conveniently sell their tokens on cryptocurrency exchanges or directly on a peer-to-peer basis.

It was Nextrope that created a dedicated token purchasing platform for the company, which it integrated with the Ethereum blockchain. If you want to know more about the whole project, check out our portfolio.

Certainty of origin

With the slow depletion of existing deposits, public interest in the ethics of extraction methods is growing. In the 21st century, the clarity of the origin of precious metals has become almost as important as their price. At the same time, in the case of gold, for example, the share of illegal and informal mining has virtually only increased since 2000.

In addition to creating a new investment mechanism, blockchain is able to completely modernise the precious metals supply chain. The origin of precious metals can be made fully transparent by using decentralised certification technologies such as IDWorksand securing all relevant information through a private blockchain (e.g. Corda's R3 network).

In short, blockchain technology allows for the unalterable recording and independent verification of data relating to each stage of the supply chain of a specific raw material. As a result, it becomes possible to precisely trace its path and detect any attempts at manipulation or fraud.

Tokenization of precious metals - future prospects

Of course, many commodities benefit from tokenization, but it is perhaps the tokenisation of those with the highest value that has the most advantages. Precious metals are one of the best assets for protecting capital from inflation and market fluctuations. And with tokenization, trading them becomes simpler than ever. Therefore, in addition to the existing tokens secured by gold or silver, those using other precious metals should soon appear. What will be next? Platinum? Palladium? The possibilities are endless...

All indications are that precious metal tokenization will be one of the hottest fintech trends in 2021!

en

en  pl

pl