The sports industry might be one of the most important branches for NFTs implementation. From rare collectibles to voting rights - NFTs revolutionize fan engagement.

Table of contents:

- What are NFTs?

- Fan participetion network

- Application of NFTs in the sport industry

- The next level of fan experience

- NFT fan engagement and the metaverse

The digital revolution has bypassed the conventional ways in which we structure our day-to-day operations, including entertainment, sports, and socialization. A token is a fragment of data that replaces another, the latter being more valuable, and which is stored on a blockchain.

Tokens come in 4 main types: security tokens, payment tokens, utility tokens and object of today’s insertion, non-fungible tokens (NFTs). Non-fungible meaning they are not interchangeable with other articles due to their intrinsic qualities. For example, you cannot exchange a fridge with a typewriter and vice versa. However, fungible items can be swapped, because they are defined by their value, not their unique properties. A prominent example would be Bitcoin or other cryptocurrencies such as Cardano which can be purchased and sold for money.

The boom of digital assets

Although initially, non-fungible tokens had limited popularity in the mass market, now they are advertised on billboards, stadiums, in media, and services. Public awareness rose with the proliferation of “Cryptokitties”, an online game where players can breed and collect virtual cats. $12 million raised in investments alone, some of the “cats” were sold for over $150,000 a piece.

Soon after, the videogame was added to the ERC-721, a free and open standard that trains users on how to build tokens on the Ethereum blockchain, thereby coining it for the first time as an NFT. Recording an overall sale of $250 million in 2020, Dap Radar’s data logged a staggering $2.47 billion in the first 6 months of 2021, an 888 % increase.

NFT space in a brief

NFTs vary in application, from digital art, gaming, music, and movies, now onto the final frontier of virtual reality, the Metaverse. The growing popularity of the token is that it provides an ownership alternative, enabling buyers to own items without having to compromise with media platforms. Ownership terminates only when the owner decides to sell the item. The key advantage is a unique and integrated blockchain mechanism that indicates effective ownership history and easily detects the authenticity of an NFT.

Moreover, the potential is believed to be transformative. As DLT economies grow and the benefits of decentralized economies become undeniable for key investment players, there will be a shift towards decentralized finance. Tokens, amongst which NFTs, are the “lifeblood of this new system” (Tech Crunch).

Where will non-fungible tokens take us?

In a standard economy, and therefore in a DLT transition, sport is a major business. Consulting agency Kearney estimates that the industry is currently worth circa $620 billion, growing faster than the global GDP, making it an el dorado for those seeking fortune. The value generated and the prospects it offers make what first appears as a strange “collaboration”, only a natural step in the next gen of value creation. That begs the question, how does this collaboration work and how can the NFTs increase the involvement of sports fans?

Fan participation framework

In the conventional, physical world, there are many ways to get involved in sports and all the entertainment around it. Some buy the merchandise, some wait for their heroes’ autograph in the blistering cold and some pass their time on collectibles, panini for example, a card cult in Italy. There is unquestionably a nostalgia and psychological dimension powering sports industry which attempts to merge innovative tech solutions to increase fans’ participation. The most recent examples of world’s most popular disciplines prove that.

Why sports fans are interested in NFTs?

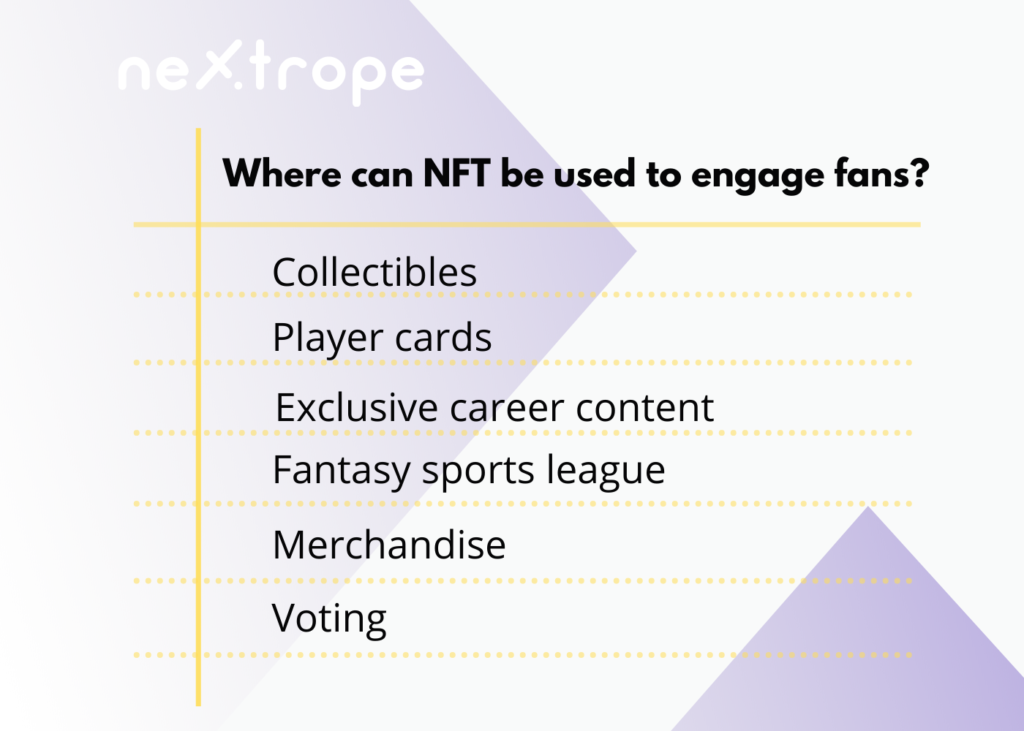

The use of NFTs is purposed towards more meaningful fan-club interactions. Collectibles or player cards are virtual, allowing fans to gather and swap stickers with unique highlights from their athletes. These cards have levels of rarity, some entering the market with a thousand-dollar price tag. That excites supporters, as it has for decades in a non-virtual environment and are thrilled to buy cards of their favorite sportsmen, even if pricey.

Case in point is Dapper Labs’ NFT marketplace platform NBA Top Shot where the lowest asking price for Ja Morant’s dunk series 1 is $475,000. Lebron James topped his legendary 32 at $535,000. Derrick Rose’s legendary 59 is currently valued at 1 million dollars.

Where new technologies meet fan base

The list goes on. The assurance to the fan is that the card becomes a non-exchangeable unit of data, meaning it holds a stamp of authenticity through the blockchain, annulling potential for fraud or mistake. The fan can trade safely, and the athlete can in fact create a novel source of income. Tampa Bay’s tight end Rob Gronkowski recently launched his personalized set of digital cards which show himself in action, removing elements that may infringe image rights, but nevertheless good enough to profit almost $ 2 million in sales.

The next level of fan engagement

Other than a business-grounded optic, NFTs encourage athletes to redefine their relationships with the public. That can be in the form of exclusive career content or rewards for the best fans including personal visits, online contact, gifts etc…. At this stage, this is hypothetical talk but done correctly, can bring the stands closer to the pitch, a dream every supporter holds.

Fantasy sports leagues

In some cases, NFTs can also be used within fantasy sports league applications, with each NFT representing a player who could be part of a team entered into season-long competitions. In the Fantasy League, an e-sports platform where users set up their own teams based on existing clubs, NFTs radically transformed the way how digital interactions related to sports now occur.

With Sorare, you create Fantasy Football lineups using NFT cards that you actually own. When the players score on the field, you win real money. The match in Russia notched Anderson a prize of 0.25 ETH (now worth around $500) and additional NFTs – more player cards – now worth over $2,000. Sorare doles out these prizes constantly. “I saw the potential right away,” says Anderson. “This is fun and engaging, and I can win NFTs and [ETH] using my passion for football and sports.” Anderson is part of a rabid group of soccer fans (120,000 active monthly users) obsessing over Sorare – an addictive blend of fantasy football, collecting and the wheeling and dealing of crypto trading. He loves it so much he started The Sorare Podcast, where guests join him to geek out over strategy.

Sportswear as a digital product

A step further past collectibles is wardrobe. Now more than ever have fashion and sports been synonymous of one another. Nike has become a dominant force in streetwear apparel besides brands such as Puma, Adidas, and Champion. Buying sportswear is a fashion statement, one that NFTs are starting to introduce in digital form. For example, Gucci Virtual 25 replicates a shoe design that can only be used in augmented reality.

Gamers (including sporting players) buy “skins” to give themselves a unique look, one that makes them stand out, and this has been going on since 2012, so the idea already exists. Until now, the industry has topped at relatively basic gear and memorabilia but with the creation of the metaverse, nothing is off the table.

How did the championship ring become a digital asset?

In basketball, 15 years onwards from Miami heat’s first championship glory, the NBA commemorated the event with an NFT collection, where virtual championship rings of the time, alongside banners and flags were offered on their digital platform. In football, ACF Fiorentina delivered special edition merchandise of jerseys for their 95-year anniversary, 95 jerseys materially and digitally available. The project was conducted on the Genuino program, a fan engagement platform where fans can purchase digital collectibles, certified by blockchain technology.

All in all, the paradigm describes a parallel shift in engagement, from physical to digital, but NFTs can do more than switch scenery, they can so to speak, buy you that sunrise view.

Decision making in sports clubs

In Japan, clubs in the non-professional shallows up until first division (J1) are adopting the token model to manage ownership structures with fans, and the sponsorship deals that underlie them. YSCC Yokohama announced that they had sold half a million dollars of tradeable fan tokens from the beginning of May, promising fans the possibility to vote on matters such as uniform design, player of the week, attend pre-match meetings with staff and access to VIP tickets.

In Turin, Juventus’s stadium, the Allianz, blasted Blur’s “Song 2” every time the “vecchia signora” would score a goal. This was possible because fans on a blockchain ecosystem called Socios.com decided so. The platform sells tokens, and the more you own, the stronger your voting powers are. The founder Arthur Dreyfus discussed the globality of the sport and that this mechanism allows fans that are away to still be part of the event, especially in times of Covid.

In theory, a song played at the Olimpico di Roma or Rajko Mitić Stadium in Belgrade can be selected by fans in India or even the Mauritius. No limits – global inclusivity is the 1st rule. It must be clear that organizations are run by professionals, so boundaries are in place and they won’t budge. Fans must make content with their role as fans, but that doesn’t mean they can’t have their piece of the pie.

NFT fan engagement and the metaverse

A study by Deloitte predicted that by the start of 2023 already 5 million fans will have either acquired NFTs or received them as a gift. There is a lot of convincing evidence to believe that fan engagement will be bolstered by activity outside of sports. Art, music, gaming, the wider possibilities are what initially will drive the NFT model, but sports, with its billions of fans around the globe, will have its say.

As strange as it appears to purchase digital content, we must understand that it is a recent phenomenon, an oddity. But with the advent of gamer culture, this is no longer the case. In 2020’s second quarter, American consumers spent about $1 billion on gaming content. By 2022, especially in case of COVID induced lockdown, tens of billions of dollars will flow into purchases. In this context, we can only expect for tokens to increase in numbers, types, and functions, and expect them to enter our everyday lives in more ways than we first thought. The sports industry may be among the first ones to experience that radical change.

en

en  pl

pl