Tokenization, a compelling tool in this digital age, has radically transformed the way businesses view and trade their assets. The triumph of any venture into tokenization relies on robust marketing techniques. Among the multitude of strategies, capitalizing on social media and influencer marketing has proved to be a significant game changer. In this article, we will be delving into how marketing plays a pivotal role in the success of tokenization and how exploiting social media and influencer collaborations can maximize the output. Gear up to unravel how these two potent strategies can boost your tokenization endeavor to unprecedented heights within the digital scenario.

Before reading this article, be sure to read out this post.

Marketing's Significant Influence on Tokenization

Benefits of tokenization, which involves transmuting real-world assets into blockchain-based digital tokens, can only be completely harnessed with a comprehensive marketing strategy. Let's delve into the monumental impact of marketing on the triumph of tokenization.

Raising Awareness and Fostering Curiosity

Identifying target audience : For effective promotional campaigns, it is fundamental to establish the distinct demographic, interests and challenges of your intended audience.

Comprehensive market research: A rigorous assessment of the market renders an understanding of the competitive climate, recognition of trends, and the discovery of valuable insights shaping marketing approaches.

Developing a persuasive value proposition: Communicate lucidly to potential investors, users and stakeholders about the distinct value and merits of your tokenization initiative. Emphasize its problem-solving capacity and its superiority over conventional mechanisms.

Constructing Reliability and Assurance

Value of transparency in tokenization ventures: Open disclosure concerning project specifications, team composition, alliance, and action plan breed trust within the community and prospective investors.

Employing marketing outlets to reinforce trust: Harness different promotional mediums like your website, social media forums, and industry publications to exhibit the authenticity and trustworthiness of your initiative.

Highlighting success narratives and endorsements: Demonstrating practical applications, success chronicles and commendations from contented users or investors aids in building dependability whilst boosting confidence in your tokenization venture.

Through execution of a well-founded marketing strategy, corporations can effectively heighten awareness, stimulate curiosity, and foster trust for their tokenization projects. We will further ascertain how social media alongside influencer marketing could augment these endeavors for successful tokenization in subsequent sections.

Utilizing Social Media for Successful Tokenization

In the current era of global connectivity, social media has become a significant aspect of our everyday lives. Given its extensive reach and engagement capacity, it serves as an efficacious instrument for propagating and securing success in tokenization initiatives. Let's dive into how companies can employ social media to heighten the influence of their tokenization attempts.

Basic Understanding of Social Media Platforms

1. Facebook: Offering an array of active users in billions, Facebook provides a varied user base and sophisticated advertising features to tap into a large audience.

2. Twitter: Renowned for instantaneous updates and succinct communication, Twitter permits companies to interact with specialists in the industry, influential persons, and participate in discussions pertinent to tokenization.

3. LinkedIn: Positioned as a professional networking site, LinkedIn empowers companies to develop thought authority, associate with probable investors, and interact with a targeted audience.

4. Instagram: Characterized by its visual appeal, Instagram is excellent for illustrating tokenization projects via enticing images and films, alluring chiefly to a younger and visually-inclined demographic.

5. Youtube: For longer videos, tutorials, vlogs.

Establishing a Prominent Social Media Standing

1. Formulating a Uniform Brand Tone and Messaging: Build an integrated brand persona and tone across social media platforms to assure consistency in your communication and explicitly express your project's distinctive value.

2. Creating Engaging Material for the Defined Audience: Design informative and aesthetically pleasing material like articles, infographics, films, and live feeds to instruct and captivate your intended audience about tokenization along with its benefits.

3. Promoting User-Sourced Content and Interaction: Actively motivate your community members and followers to contribute their experiences, views, and endorsements concerning your tokenization scheme. This incites interaction and generates a community feel around your label.

Applying Social Media Advertising Features & Targeting Tools

1. Paid Advertisements & Sponsored Content: Employ specific advertising options provided by social media platforms to cater to distinctive demographics and interests related to your tokenization initiative. Sponsored content can further assist in enhancing visibility and reach.

2. Accurate Audience Targeting Based on Demographics & Interests: Capitalize on the advanced targeting features offered by social media platforms for defining your audience based on factors like age, location, profession, and hobbies ensuring content dissemination amongst the most appropriate individuals.

3. Usage of Analytics for Optimization & Tracing ROI: Leverage analytics tools provided by social media platforms for monitoring your campaign performance, recognizing areas requiring enhancement, & evaluating the return on investment (ROI) of your social media promotional endeavors.

By tactically utilizing social media platforms, companies can augment their impact area; interact with their desired audience; cement robust online visibility for their tokenization schemes. In the subsequent segment, we will examine the potential role of influencer marketing towards accomplishing success in tokenization.

Tokenization and Influencer Marketing

The growing field of influencer marketing is becoming a potent strategy for the promotion of goods and services, and contains a great deal of untapped potential for aiding in the success of tokenization projects. Companies can expand their reach and build reliance by forming alliances with influential personalities in the sphere of blockchain and cryptocurrency. The following will examine essential aspects of how influencer marketing has pertinence to tokenization.

Exploring Influencer Marketing

Understanding the Concept: Influencer marketing is the process of teaming up with people who have garnered a massive and significant following in a specific industry or section. These influencers can persuade the sentiments and actions of their audience, making them an invaluable asset for propagating tokenization ventures.

Pinpointing Pertinent Influencers in Cryptocurrency and Blockchain

Discovering Thought Leaders, Industry Gurus, and Influencers: Undertake exhaustive research to pinpoint influencers who are versed in areas like blockchain technology, tokenization, and cryptocurrencies. Probe for individuals who have significant audience size and engagement on platforms such as Twitter, Youtube, and blogs specific to the industry.

Assessing Engagement Levels and Audience Scope: Evaluate aspects such as the influencer’s demographics of the audience, size, and engagement rates through likes, comments, shares. Verify whether their audience correlates with your target customer base so that they have an active follower base.

Formulating Partnerships with Influencers

Establishing Genuine Connections with Influencers: Approach influencers authentically expressing interest in their work to develop a partnership that benefits both parties mutually. Engage actively with their content, provide valuable insights, thus fostering trustworthy connections based on shared principles.

Collaborating for Content Creation: Work in alignment with influencers for the production of exciting content that enlightens their audience about the benefits of tokenization. This can be achieved by sponsored posts, opinion pieces as guest bloggers, interviews, or collaborative videos.

Endorsements from Influencers: Trust in a tokenization project gains a significant boost if it is endorsed or recommended by influencers. Spurring on influencers to discuss your project candidly amongst their followers will prove beneficial.

Regulatory Compliance: Make sure that your influencers comply with regulatory guidelines and provide complete disclosure concerning their partnerships. Abiding by legal protocols while maintaining ethical standards is paramount to building credibility.

By pairing up with influencers who can extend their reach into wider networks and audiences effectively validates tokenization projects’ effectiveness. An overview of best practices for successful tokenization campaigns utilizing social media and influencer marketing will be discussed subsequently.

Optimal Strategies for Social Media and Influencer Marketing

Businesses must adopt best practices to optimally utilize social media and influencer marketing in their tokenization projects, ensuring enduring success through enhanced engagement and credibility. Below are some critical pointers.

Regularity and Diversity in Content Publications

Maintain a routine posting schedule: Regular dissemination of engaging and valuable material aids in establishing a robust digital footprint across social media platforms. Consistency cultivates trust while keeping your audience engaged.

Variety in content types: Experimenting with an array of content types such as articles, videos, infographics, live streams could cater to diverse tastes and captivate your followers.

Supervision of and Response to User Interaction

Monitor social media interactions: Stay up-to-date with all comments, messages, and mentions pertaining to your tokenization project. An immediate response to user inquiries or feedback demonstrates dedication to customer satisfaction.

Promote and acknowledge user-created content: Bolster community engagement by encouraging users' contribution towards your project-related content and appreciating their input publicly. This tactic amplifies engagement and fortifies the relationship between your brand and followers.

Key Metric Evaluation and Performance Analysis

Specify measurable targets: Key performance indicators like engagement rate, reach, website traffic, conversions should be set in place to gauge the success rate of social media campaigns along with the influencer marketing strategy.

Implementation of analytics tools: By utilizing the analytics provisions by social media or third-party interfaces, you gain a deeper understanding of user patterns, content efficacy, audience demographics that further help optimise your marketing techniques.

Compliance with Legal Regulations

Comply with relevant norms: Keep yourself updated on legal norms around tokenization within advertisements in the blockchain or cryptocurrency industry. Maintain this compliance to ensure an ethical approach to marketing.

Transparency in influencer collaborations: Choose influencers who abide by disclosure requirements mandating them reveal their relationships when promoting your tokenization project. Honesty enhances credibility aiding in building trust.

The importance of constant innovation, optimization along staying abreast industry developments is critical for an enduring success in marketing these tokens. The next section concludes with an overview on the significance of both social media based and influencers' marketing within this realm coupled with a compelling call for businesses to incorporate such strategies within their marketing initiatives.

Conclusion

Capitalizing on social media and influencer marketing is a vital step forward for businesses aiming to harness the full benefits of tokenization and elevate their projects in the digital realm. Tokenization projects gain momentum and achieve success through these strategies by tapping into a broader audience base, building authenticity and sparking curiosity. It involves adherence to best practices such as posting content regularly, engaging actively, and conforming to regulations. This efficient marketing strategy optimization promises astonishing outcomes.

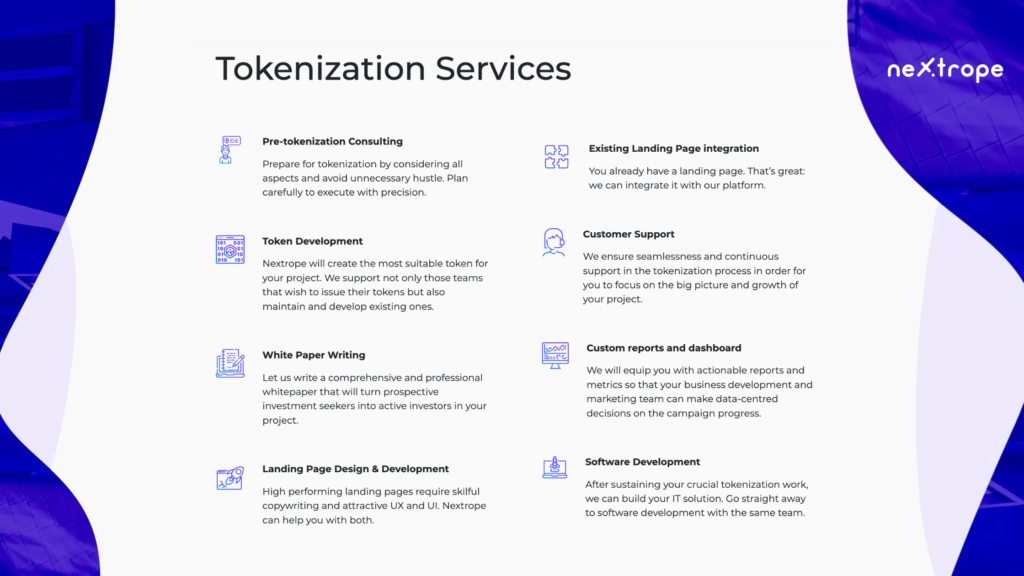

Nextrope Tokenization Launchpad Platform

Nextrope Launchpad Platform is a White Label solution in a Software-as-a-Service model that helps you launch your project within a month and fundraise with Initial Coin Offering (ICO) or Security Token Offering (STO).

Our platform allows you to participate in the broad financial market of digital assets. Expand your reach and find investors globally. Tokenize your project and start raising capital within a month!

en

en  pl

pl