Staying abreast of the latest developments within the blockchain ecosystem is crucial for enthusiasts, developers, and investors alike. One such improvement that has recently garnered significant attention in the crypto space is the ERC-3643 token standard. It stands out in the crowded field of Ethereum introducing novel features that address specific needs in the current infrastructure. Consequently, interest in decentralized finance, allied with demands for reliability, and efficiency, underscores ERC-3643’s emergence as timely. The potential to revolutionize asset creation, control, and transfer opens new avenues for token smart contract management.

Understanding ERC-3643

Definition and Concept

ERC-3643 describes a set of rules for issuing and managing tokens on the Ethereum network. These can represent a wide array of assets, ranging from cryptocurrencies to digital means identifying physical properties. What sets a new standard apart is a focus on compliance and regulatory adherence. It originates from previous ERC-proposals limitations, being more versatile, secure, and willing to adopt. To sum up, ERC-3643 embodies learning and experiences, distilling them into a structure aligned with different regulatory jurisdictions.

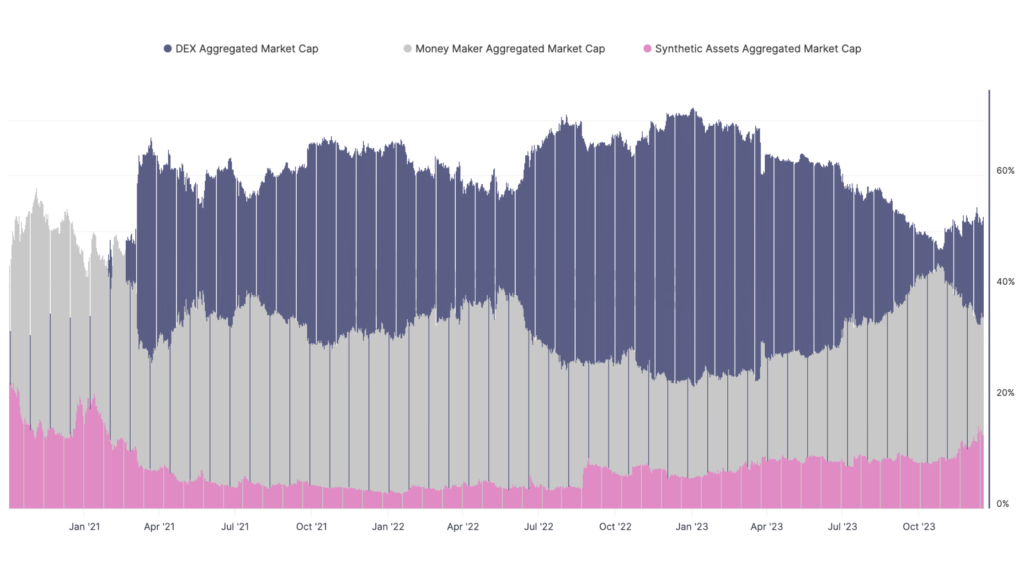

Defi sectors – perspective on Market Cap dominance

The chart shows different sectors’ dominance within the DeFi market. A brief glossary may help you clarify the subject. DEXes, such as Decentralized Exchanges, include Automated Market Maker (AMM) protocols that handle peer-to-peer (P2P) transactions. Money Makers provide P2P lending and borrowing services. Synthetic Assets are tokenized derivatives, for instance, bonds, stocks, and shares.

Source: Glassnode Studio

Key Features of ERC-3643

Integrity with existing Blockchain Systems

Designed with interoperability in mind, ERC-3643 enables token synchronization between legacy Ethereum-based applications. Projects willing to upgrade, if EVM-compliant, are stripped of the need for much infrastructure overhauls.

Conclusion

The blockchain industry continues to mature interfacing closely with traditional funds. ERC-3643 might likely pioneer in breaking the yearslong wall between innovation, regulatory, and mainstream finances. The journey is confidently not without challenges, adapting burden to the ever-evolving landscape. One thing is certain, you’ll find out in the upcoming threads!

If you are interested in utilizing ERC-3643 or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

FAQ

What are the key features of ERC-3643?

- It emphasizes compliance and regulatory adherence, offering versatility, security, and interoperability with existing blockchain systems.

How does ERC-3643 relate to the DeFi market?

- It addresses the needs of the DeFi market by providing integrity with existing blockchain systems, enabling token synchronization between different applications.

What does ERC-3643 aim to achieve?

- ERC-3643 aims to bridge the gap between innovation, regulatory compliance, and mainstream finances, pioneering advancements in the blockchain industry.