The community's involvement in the research and development of blockchain technology is once again challenging traditional paradigms. As we have previously observed, the tokenization of Real World Assets (RWAs) has faced a multitude of challenges. ERC-3643 approaches the legal sphere with flexibility and the utmost care, facilitating the proficient integration and use of blockchain infrastructure for assets of various kinds. In this article, we will explore the essence and advantages of this standard, along with potential complexities that may be lurking.

ERC-3643 and Overall Considerations

Trust

Transfers of ERC-20 tokens typically follow a specific process on Ethereum Virtual Machine (EVM) blockchains, adhering to the standard ERC-20 implementation. This process includes the initiation, approval, and eventual transfer of the tokens. Normally, KYC (Know Your Customer) and AML (Anti-Money Laundering) checks require integration with external APIs.

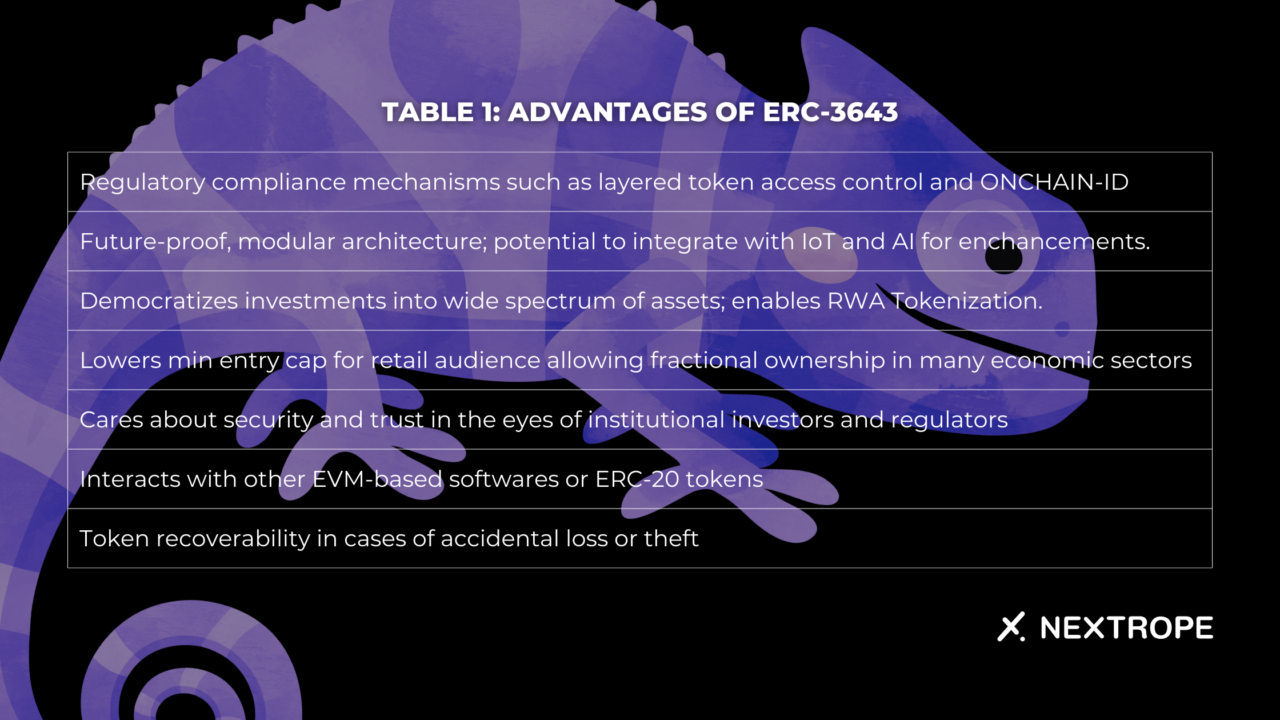

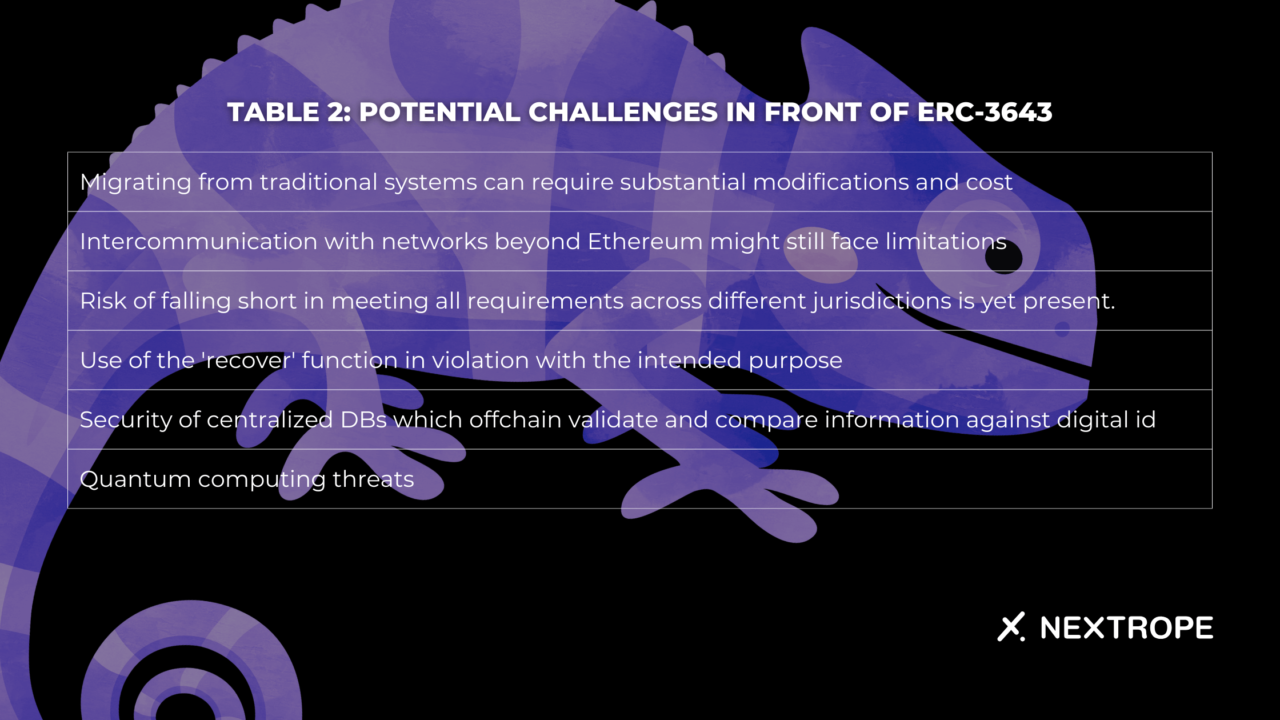

ERC-3643 uses a model that necessitates predefined criteria before transfer execution. The standard integrates ONCHAINID, which acts as a smart contract for a digital identity management system. It enables third-party-issued identification certificates and KYC or AML service providers to interact and enforce legislative requirements on the tokens. Linking an investor's wallet to an ONCHAINID represents a significant shift in the security tokens market. Issuers can recover the token balance using the 'recovery' function when necessary. This process involves comparing and validating information with associated off-chain databases.

Usability

ERC-3643's design acknowledges the global scope of blockchain applications and caters to cross-jurisdictional landscapes through modular design. Its architecture features transaction limits, investor qualifications, and geographical restrictions checks. It communicates with existing EVM-compatible systems or ERC-20-based tokens. The strong emphasis on regulations has some implications for investor confidence. Institutional bodies prioritize legal safety and risk management and most likely ERC-3643 fits both rigorous financial policies and a string of assets tokenization demands. It allows for the implementation of multi-level permissions and roles within its token ecosystem. This hierarchical structure adds an extra layer of security, as it controls who can execute specific actions within the token’s life cycle.

ERC-3643 and Artificial Intelligence

The convergence of blockchain technology and Artificial Intelligence (AI) tools heralds a groundbreaking synergy, poised to unlock new capabilities. This triad of technologies intertwines to create a more intelligent, efficient, and secure ecosystem. By integrating AI algorithms with ERC-3643's smart contracts, there is a significant leap in automated decision-making capabilities. AI can analyze vast amounts of data to make informed decisions about token transactions, ensuring compliance, and optimizing operational efficiency. AI's ability to process and analyze complex datasets simplifies intricate processes involved in token management. It enables more nuanced and sophisticated handling of ERC-3643 tokens, catering to a variety of use cases without adding operational complexity. The integration of AI tools can optimize transactional processes within the ERC-3643 framework, enhancing speed and reducing costs.

Closer Outlook

Table 1: Advantages of ERC-3643

Table 2: Potential Challenges in Front of ERC-3643

Wondering how this standard performs against other protocols? We have previously compared the ERC-1400 and ERC-3643 capabilities.

Conclusion

By facilitating a secure and compliant environment for tokenization, ERC-3643 encourages innovation in the digital asset space. It seeks to evolve alongside changing global regulatory jurisdictions. Further enhancements may include more sophisticated mechanisms. Undoubtedly, the TREX protocol remains at the forefront of blockchain technology adaptability, not only limited to intangible assets like intellectual property and patents. From agriculture to entertainment, becoming more deeply integrated into DeFi ecosystems, offering novel investment opportunities. The standard establishes a foundation for growth, although it appears innovative, flexible, and compliance-oriented, it might not be without drawbacks.

If you are interested in utilizing ERC-3643 or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

FAQ

What is ERC-3643 and how does it improve tokenization?

- ERC-3643 is a standard for tokenizing Real World Assets (RWAs) on blockchain. It integrates with legal frameworks, ensuring secure asset transfers and compliance with regulations like KYC/AML.

How does ERC-3643 address regulatory compliance?

- ERC-3643 utilizes ONCHAINID for identity verification and regulatory enforcement. It includes features like transaction limits and investor qualifications to meet global regulatory requirements.

What are the main advantages of ERC-3643?

- ERC-3643 offers enhanced security through multi-level permissions, global applicability, and integration with existing systems. It also enables the integration of blockchain with AI tools for optimized operations.

What challenges might ERC-3643 face?

- Challenges include regulatory complexity, interoperability with existing systems, and scalability for handling various asset types and transaction volumes.

en

en  pl

pl