DeFi is transforming the financial sector by making it accessible to everyone, bypassing traditional institutions. It leverages blockchain to offer financial products widely, improving transparency and security through smart contracts.

At the heart of DeFi’s functionality and its promise of creating more trustworthy financial applications lies Chainlink’s oracle technology. Chainlink oracles are pivotal in bridging the gap between blockchain smart contracts and the external world, enabling these contracts to interact with real-world data in a secure and reliable manner. This critical integration allows for the execution of complex financial products and services within the DeFi ecosystem.

Decentralized Finance (DeFi) Overview

DeFi represents a paradigm shift in the financial industry, aiming to remove the barriers and inefficiencies associated with traditional finance. By utilizing blockchain technology and smart contracts, DeFi platforms offer a plethora of financial services. This not only makes financial products more accessible to a global audience but also significantly reduces the costs and complexities involved in financial transactions.

One of the most compelling promises of DeFi is its potential to provide universal financial accessibility. In traditional finance, services are often restricted to those with a bank account or sufficient capital. DeFi opens the doors to anyone with an internet connection. However, this revolutionary approach does not come without its challenges. Traditional finance systems are plagued by issues like gatekeeping, where powerful entities control access to financial services, and counterparty risk. The trustworthiness of one party can jeopardize the execution of financial agreements. DeFi seeks to address these problems by offering a transparent, permissionless, and trustless financial ecosystem.

MUST READ: “DeFi and the Future of Finance“

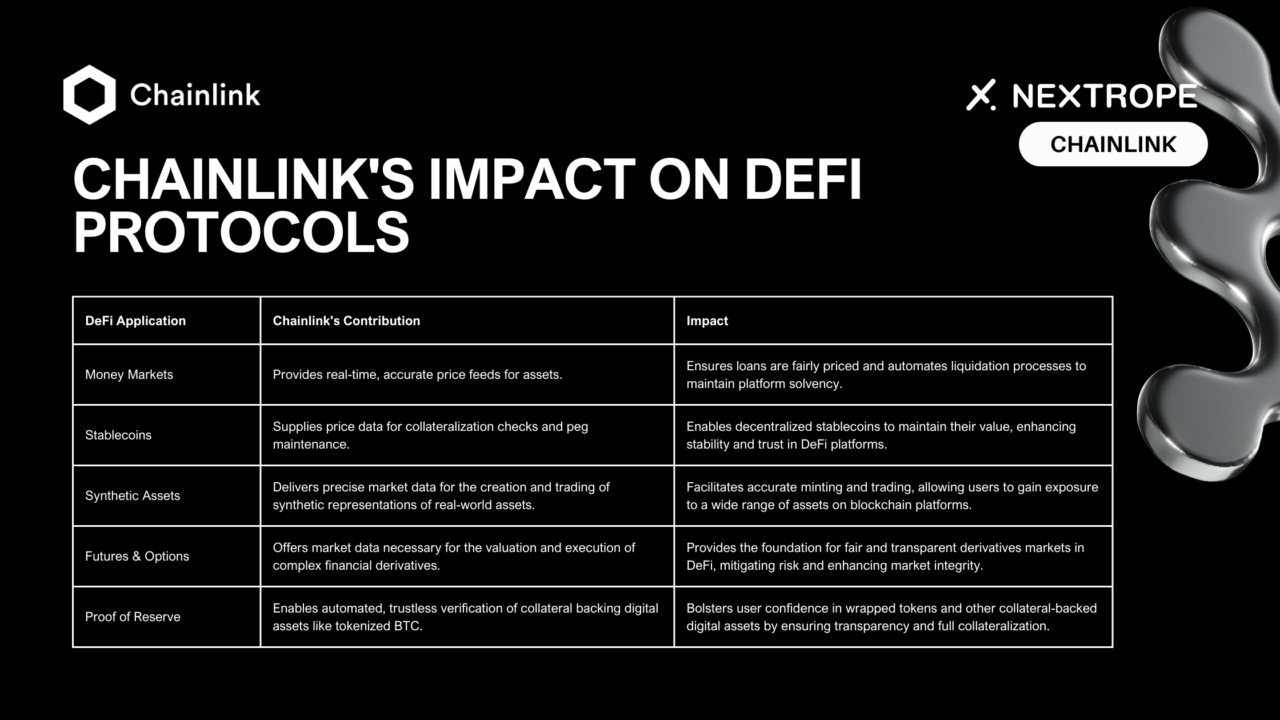

Chainlink’s Impact Across DeFi Protocols

Money Markets

In the realm of DeFi, money markets offer platforms where users can lend and borrow cryptocurrencies, earning interest on assets or paying interest for loans. The accuracy of asset valuation is paramount in these platforms to maintain solvency and ensure fair and secure transactions.

- Chainlink’s Role. Money market protocols like Aave, Compound, and Liquity can access real-time data by integrating Chainlink Price Feeds. This data is crucial for calculating the value of collateral and debt. It determines interest rates, and triggering liquidations for undercollateralized loans, thereby safeguarding the protocol and its users’ assets.

Decentralized Stablecoins

Stablecoins are a cornerstone of the DeFi ecosystem, providing a stable medium of exchange and store of value. Decentralized stablecoins, in particular, rely heavily on accurate and timely price information to maintain their peg to fiat currencies.

- Chainlink’s Contribution. For decentralized stablecoin platforms like DeFiDollar, Chainlink Price Feeds are indispensable for monitoring the value of underlying assets (such as sUSD, USDT, DAI, and USDC). This enables these platforms to execute rebalancing actions efficiently and maintain their stable value, even amidst volatile market conditions.

Algorithmic Stablecoins

Algorithmic stablecoins use a combination of incentives and monetary policy mechanisms to maintain their peg to other currencies without relying solely on collateral. The success of these mechanisms hinges on accurate and reliable market data.

- Implementation by Chainlink. Projects like Fei Protocol utilize Chainlink Price Feeds to adjust their algorithms in response to real-time market conditions, ensuring their stablecoins remain close to their target peg, thus maintaining stability and user confidence.

Futures and Perpetual Contracts

Futures and perpetual contracts allow users to speculate on the future prices of assets or hedge against price movements, requiring precise and up-to-date asset pricing for fair contract settlement and liquidation.

- Chainlink’s Utility. Protocols such as Lyra and MCDEX leverage Chainlink Price Feeds for determining the settlement prices of futures contracts and the real-time valuation of assets for perpetual contracts. This ensures that these financial instruments operate transparently and fairly, with all parties confident in the integrity of their trades.

Synthetic Assets

Synthetic assets enable users to gain exposure to a variety of real-world assets, indices, and commodities within the blockchain space. The creation and trading of these assets depend on accurate price information to mirror the real-world market values.

- Chainlink’s Role. Synthetix is a prime example of a protocol that uses Chainlink Price Feeds to mint and trade synthetic assets. By providing reliable access to real-time price data, Chainlink enables Synthetix users to create and exchange synthetic assets that accurately reflect the value of their real-world counterparts.

Impact on DeFi Protocols – Chainlink

MUST READ: “What is Chainlink“

Enhancing DeFi with Accurate Data (Chainlink)

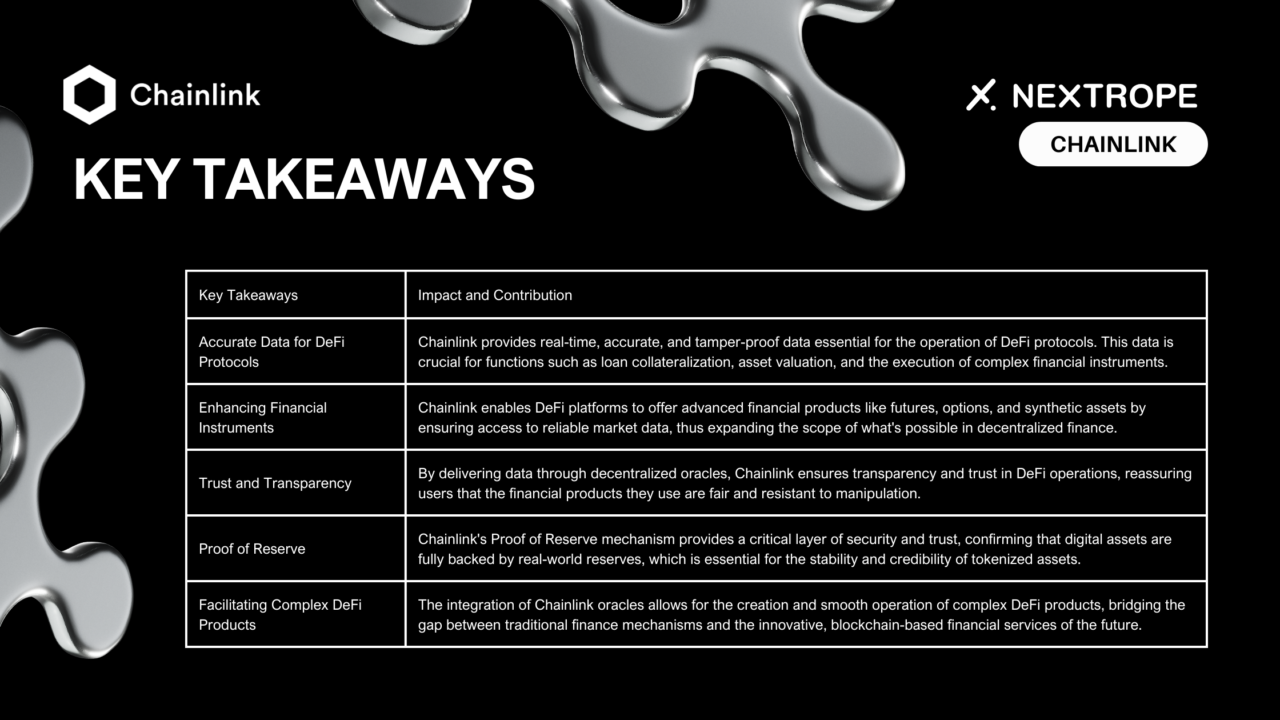

Chainlink’s integration across the DeFi ecosystem is transforming how financial protocols operate, providing them with the critical infrastructure for secure and efficient interaction with real-world data. From money markets to synthetic assets, Chainlink ensures accuracy, fairness, and transparency, underpinning the trust and reliability essential for DeFi’s operation and growth.

Key Takeaways – Chainlink

Conclusion DeFi

Chainlink is instrumental in DeFi’s evolution, offering a bridge to real-world data that’s essential for the ecosystem’s functionality and trust. By enabling complex financial instruments on the blockchain, Chainlink not only fosters innovation within DeFi but also ensures that these advancements are built on a foundation of accuracy and transparency. As DeFi grows, Chainlink’s role as a trusted data provider will continue to be central to its success and expansion, ensuring a more inclusive and fair financial system.

If you are interested in utilizing Chainlink or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

DeFi Staking Revolution by Nextrope

FAQ

What role does Chainlink play in the operation of decentralized stablecoins?

- Chainlink Price Feeds offer essential price information for platforms like DeFiDollar, enabling them to maintain stable values even in volatile markets.

How do algorithmic stablecoins benefit from Chainlink’s technology?

- Chainlink Price Feeds help projects like Fei Protocol adjust their algorithms according to market conditions, ensuring stablecoin pegs are maintained.

How does Chainlink ensure the reliability and security of its data feeds?

- An exploration of the mechanisms Chainlink employs to protect against manipulation and ensure the accuracy and timeliness of its data feeds could be of interest.