The importance of interoperability within various ecosystems cannot be overstated. In a domain characterized by an abundance of isolated blockchain networks, the ability to transfer assets and information across different blockchains is indispensable. So, what is MOST?

The Genesis of MOST: A Bridge to Ethereum

Aleph Zero’s Interoperability Vision

At the heart of Aleph Zero‘s strategy to forge a more interconnected blockchain world lies MOST, an avant-garde bridge designed to seamlessly connect Aleph Zero with the Ethereum ecosystem. MOST represents a critical step forward in Aleph Zero’s commitment to building a robust, independent, and versatile platform. It embodies the vision of a blockchain ecosystem that is not only self-sufficient but also fully integrated with the broader digital asset landscape.

The Role of MOST in Enhancing Aleph Zero’s Interoperability with Ethereum

MOST is a strategic asset that enhances Aleph Zero’s interoperability with Ethereum. By facilitating a direct pathway for asset transfer between Aleph Zero and Ethereum, MOST empowers developers and users alike to leverage the strengths of both platforms. This synergy amplifies the potential for decentralized applications (dApps) and decentralized finance (DeFi) projects to flourish, benefiting from the combined advantages of Aleph Zero’s scalability and Ethereum’s vibrant ecosystem.

READ: “What is Aleph Zero?“

The Design and Functionality of MOST

Overview of MOST’s Guardian-based Design

The architecture of MOST is grounded in a guardian-based design, prioritizing security and simplicity in asset transfer. This design framework ensures that the bridge operates with utmost integrity and reliability. Guardians, selected through a meticulous process, play a pivotal role in maintaining the bridge’s operational excellence. Each guardian oversees two instances of the setup—one for the Testnet and one for the Mainnet—thereby ensuring a robust testing and deployment framework that safeguards against vulnerabilities.

The Selection and Role of Guardians

The guardians of MOST are not just custodians of the bridge’s technical infrastructure; they are the linchpins of its governance model. With control over governance keys for both Aleph Zero and Ethereum, guardians possess the authority to enact changes to the committee’s composition, perform contract upgrades, and undertake other critical governance functions. This multi-signature wallet setup ensures a decentralized control mechanism, crucial for maintaining the bridge’s security and integrity.

Key Features: Reduced Fees, Incentivizing Liquidity, and a Focus on Security

MOST is engineered with several key features designed to optimize user experience and ecosystem growth. One of its standout attributes is the significant reduction in fees for bridging assets such as native ETH, stablecoins, and other tokens from Ethereum to Aleph Zero. This fee structure is strategically designed to attract liquidity to the Aleph Zero ecosystem, thereby enhancing its vibrancy and utility.

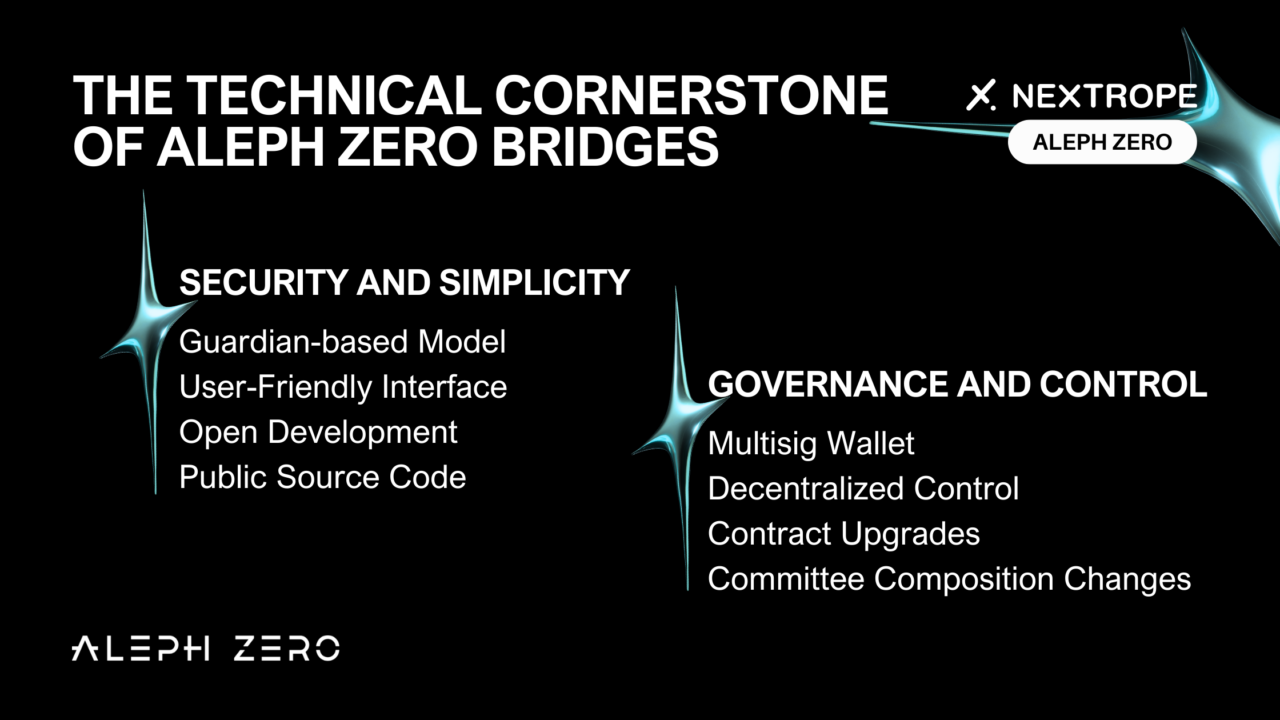

The Technical Cornerstone of Aleph Zero Bridges

Security and Simplicity

MOST’s design focuses on security, simplicity, and ease of use. It uses a guardian-based model for robust security and offers a straightforward interface for users. Development has been open and meticulous, with the project set to release its source code publicly, aligning with open-source principles and ensuring transparency.

Governance and Control

Governance in MOST uses a multisig wallet, allowing guardians to manage operations democratically. This setup ensures decentralized control, with mechanisms for contract upgrades and committee changes, enhancing security and flexibility.

Here you can stay tuned for the upcoming updates about Aleph Zero bridges: BLOG

Broader Impact on the Ecosystem

Enhancing DeFi on Aleph Zero

MOST facilitates the influx of liquidity and stablecoins into Aleph Zero, significantly boosting its DeFi sector. This bridge to Ethereum encourages innovation, user engagement, and ecosystem growth.

MOST and Beyond: Comprehensive Bridging Strategy

Integration with Router Protocol

Aleph Zero’s partnership with Router Protocol expands its connectivity to various blockchains. The collaboration focuses on simplifying cross-chain operations through the Cross-chain Intent Framework (CCIP), broadening Aleph Zero’s interoperability.

The zParachain Bridge to Polkadot

Using a parachain slot, the zParachain bridge connects Aleph Zero and Polkadot without making Aleph Zero a parachain. This innovative approach enhances cross-chain communication, strengthening Aleph Zero’s interoperability position.

Why This Matters

Aleph Zero’s bridging strategy highlights the need for stable, secure, and versatile connections across blockchains. By ensuring broad connectivity, Aleph Zero paves the way for a more integrated blockchain ecosystem, where seamless interoperability enhances the overall utility and accessibility of decentralized technologies.

READ: “Aleph Zero vs Solana: A Comparative Analysis“

Conclusion

Aleph Zero’s efforts in bridging technologies mark a leap towards a unified blockchain world. Aleph Zero Bridges? Focusing on key areas like security, simplicity, and ecosystem integration, Aleph Zero is shaping the future of blockchain interoperability, fostering innovation and opening new possibilities for the DeFi and dApp sectors.

If you are interested in utilizing Aleph-Zero or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

FAQ

1. What is the main purpose of the MOST bridge in the Aleph Zero ecosystem?

- MOST is designed to enhance Aleph Zero’s interoperability with Ethereum, enabling seamless asset transfers between the two platforms.

2. How does the guardian-based design of MOST enhance its security?

- The guardian-based design prioritizes security and simplicity in asset transfer. Guardians, who are meticulously selected, oversee the bridge’s operations on both the Testnet and Mainnet.

3. What are the key features of MOST, and how do they benefit users?

- MOST’s key features include reduced fees for bridging assets like native ETH, stablecoins, and tokens from Ethereum to Aleph Zero. This design is aimed at attracting liquidity to Aleph Zero, enhancing its ecosystem’s vibrancy and utility, and optimizing the user experience.