Introduction

The world of finance is ever-evolving, and technology has always been at the forefront of this transformation. One of the most exciting advancements in recent years is the growing use of artificial intelligence (AI) in various aspects of the finance industry, including accounting. AI is revolutionizing traditional practices, resulting in improved efficiency and accuracy while minimizing human error. Let's take a closer look at how AI is redefining accounting and its far-reaching impact on the finance world.

AI in Accounting Use Cases

A significant aspect of an accountant's job involves handling routine tasks, such as data entry, reconciliations, and report generation. AI-powered systems can efficiently deal with these repetitive duties, freeing up accountants to focus on more strategic responsibilities. Automating these mundane tasks not only saves valuable time but also reduces the risk of errors that come from manual input.

- Enhanced Fraud Detection

Fraud in the financial sector is a persistent challenge, with businesses continuously seeking ways to combat it. Machine learning – a subset of AI – detects inconsistencies and anomalies within large data sets, making it highly effective for fraud detection. With AI capabilities, accounting systems can now identify irregular patterns or transactions in real-time, alerting businesses to potential fraudulent activities and minimizing losses.

- Better Financial Forecasting

Predictive analytics is another area where AI proves instrumental for accounting professionals. By analyzing historical patterns, alongside external factors such as economic indicators and market trends, AI-driven algorithms can provide accountants with valuable insights into future financial performance. With more accurate forecasting information at their fingertips, businesses can make informed strategic decisions and better plan for future growth.

- Improved Audit Process

Traditional audit methods rely on sampling techniques, which often consist of taking a subset of a company's transactions to assess compliance with regulations or internal policies. However, AI enables auditors to analyze entire transaction histories using intelligent algorithms designed to identify errors, anomalies, or signs of fraud. This comprehensive analysis guarantees a more thorough audit process and accuracy, allowing businesses to identify and address issues more effectively.

- Personalized Financial Advisory Services

With the combination of AI and big data, accountants can provide tailor-made financial advisory services to their clients. By tapping into vast amounts of data from diverse sources, AI enables professionals to better understand their clients' financial needs, behavior, and goals. With these insights at hand, they can offer customized recommendations and strategies to help individuals or businesses achieve their financial aspirations.

Benefits of AI Accounting

Improved accuracy

One of the main advantages of using AI in accounting is the increased accuracy it brings to the table. Manual data entry and calculations can lead to errors, potentially costing businesses a significant amount of money. AI systems, on the other hand, minimize these mistakes by automating processes and cross-checking data for consistency.

Time savings

By automating manual tasks like data entry, categorization, and reconciliations, AI accounting tools free up time for accountants to focus on more strategic initiatives. This not only boosts productivity but also adds value to the services offered by accounting professionals.

Enhanced decision-making capabilities

AI technology can analyze large sets of financial data quickly and efficiently, identifying patterns and trends that may not be immediately apparent to human analysts. This enables accountants and business owners to make better-informed decisions based on real-time insights.

Fraud detection

With cybercrime being a prevalent issue in today's business world, AI-powered tools can help detect any suspicious behavior or anomalies in accounting records early on. This allows organizations to mitigate potential risks associated with fraud or financial mismanagement.

Cost savings

By automating routine tasks and reducing the need for manual intervention, AI accounting software helps businesses cut down on labor costs without sacrificing quality or accuracy.

Top AI-Driven Accounting Software & Tools for Streamlined Financial Management

In today's rapidly advancing technological landscape, artificial intelligence (AI) is revolutionizing the world of accounting and finance. The top AI-driven accounting software and tools offer exceptional solutions to facilitate streamlined financial management, enhancing efficiency, accuracy, and overall productivity. Stay ahead of the curve and transform your financial operations with these cutting-edge tools that are setting new standards for the industry.

Xero

Xero's AI-enhanced capabilities include automated bank feeds and invoice generation, which greatly simplify bookkeeping tasks and reduce human errors. The platform's intelligent algorithms allow for smooth integration with various banking institutions, providing real-time updates that make financial management more efficient for businesses of all sizes.

Sage Intacct

Sage Intacct employs state-of-the-art AI technology to automate financial tracking, ensuring consistent data across multiple business activities. This sophisticated software boosts overall financial accuracy and control, granting companies enhanced visibility into their financial performance and enabling better decision-making processes.

Botkeeper

Botkeeper combines innovative AI technology with certified accountants to provide precise bookkeeping services and real-time insights into a business's financial health. This cutting-edge approach empowers businesses to refine their financial management strategies while reducing the reliance on labor-intensive manual tasks.

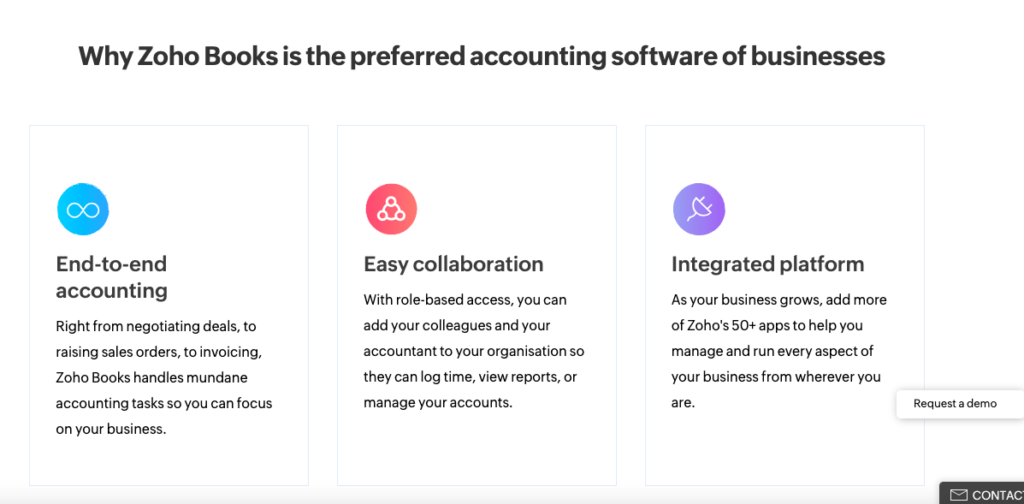

Zoho Books

Zoho Books leverages artificial intelligence in its automated bank reconciliation feature, effectively eliminating the need for manual efforts by business owners in managing their finances. This capability allows them to closely monitor their financial status and ensure efficient allocation of funds throughout all aspects of their operations, ultimately contributing to sustained growth and success.

Conclusion

In conclusion, the integration of AI in accounting is revolutionizing the finance world and profoundly impacting the way businesses and individuals manage their financial activities. This technological transformation has the potential to increase efficiency, reduce errors, provide actionable insights, and enhance decision-making processes. As AI continues to mature and develop, its influence on accounting can only expand further, ensuring a more streamlined, accurate, and sophisticated future for the financial sector. Embracing these innovations will be crucial for organizations to stay competitive and adaptive in an ever-evolving landscape.

en

en  pl

pl