The evolution of blockchain technology has brought forward numerous platforms aiming to solve various challenges in the digital world. Among these innovations, Aleph Zero stands out with its unique approach to creating an economically viable ecosystem through thoughtful tokenomics and incentives. This article delves into the economy of Aleph Zero, focusing on its native token, AZERO, to understand how it sustains growth, incentivizes participation, and ensures long-term viability.

MUST READ: “What is Aleph Zero“

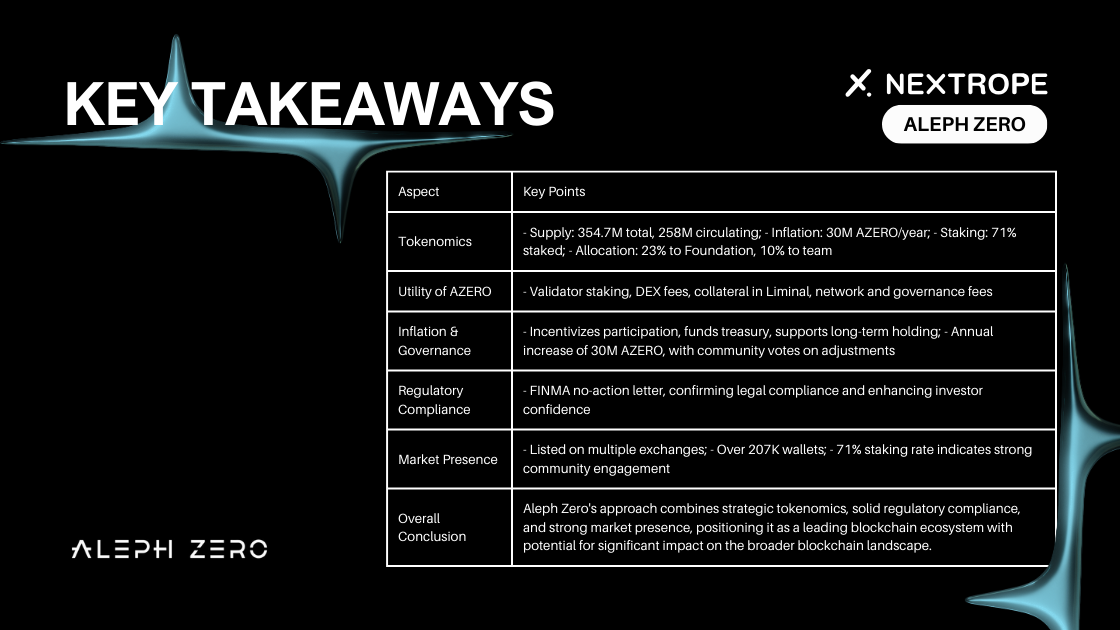

Understanding AZERO Tokenomics

Key Metrics and Distribution

- Ticker: AZERO

- Type: Utility

- Circulating Supply: 257,990,631

- Total Supply: 354,678,137

- % Staked: 71%

- # of Wallets: 207,370

- Inflation: 30,000,000 AZERO per year

- Market Cap: $410,598,781

Allocation and Use Cases

- Aleph Zero Foundation. 23% of the tokens are allocated for research, development, marketing, operations, ecosystem incentives, and other expenses.

- Team Allocation. 10% of the tokens, with 80% locked for one year and vested over four years.

- Funding Rounds. Details on the pre-seed, seed, Early Community round, public presale, and public sale distributions.

- AZERO Utility. The AZERO coin powers the Aleph Zero ecosystem by being used for validator node staking, DEX swap fees, collateral for wrapped assets in Liminal, fees for asset-wrapping and bridging on Liminal, network fees, and governance voting processes.

The Role of Inflation in Aleph Zero’s Ecosystem

Inflation is often viewed negatively in traditional economic contexts, associated with diminishing purchasing power and economic instability. However, in the realm of blockchain ecosystems like Aleph Zero, inflation serves as a pivotal mechanism for fostering sustainable growth, incentivizing network participation, and ensuring the long-term viability of the platform. This article explores the nuanced role of inflation within Aleph Zero’s ecosystem, detailing its introduction, benefits, and governance.

Introduction of Inflation

Aleph Zero has introduced a systematic annual increase of 30 million AZERO tokens to its circulating supply, a decision rooted in the desire to sustain and nurture ecosystem growth. This inflationary mechanism is not merely a tool for increasing token supply but a strategic approach to enhancing the network’s security, scalability, and development. By carefully calibrating the rate of inflation, Aleph Zero aims to balance the need for rewarding network participants with the imperative of maintaining the token’s value over time.

Benefits of Inflation

The introduction of inflation within Aleph Zero’s ecosystem serves multiple critical functions, each contributing to the platform’s overarching goals:

- Incentivizing Validators and Nominators. Validators and nominators play a crucial role in securing the Aleph Zero network through the proof-of-stake consensus mechanism. Inflation provides these participants with financial rewards for their efforts, encouraging continued engagement and investment in the network’s health and security.

- Funding Ecosystem Treasury. A portion of the newly minted AZERO tokens is allocated to the ecosystem treasury each year. These funds are instrumental in supporting ongoing development projects, marketing initiatives, operational expenses, and other activities that contribute to the ecosystem’s growth and sustainability.

- Supporting Long-Term Holding. By distributing inflation rewards primarily to those who stake their tokens, Aleph Zero encourages long-term holding over speculative trading. This strategy aims to reduce market volatility and foster a stable economic environment conducive to gradual growth.

Inflation Mechanism and Governance

Validators and Nominators

At the heart of Aleph Zero’s security and efficiency are its validators and nominators, who ensure the integrity of transactions and the network at large. Inflation directly supports these roles by compensating participants for their staked tokens and the risks associated with securing the network. This compensation not only rewards current participants but also attracts new validators and nominators, enhancing the network’s decentralization and resilience.

Ecosystem Treasury

The ecosystem treasury represents a vital component of Aleph Zero’s inflation strategy, receiving a dedicated portion of the annual inflation to fund various initiatives. These initiatives range from research and development to community engagement programs, all aimed at bolstering the ecosystem’s health and competitiveness. The treasury’s role is pivotal in allocating resources efficiently to areas that promise the most significant impact on Aleph Zero’s growth and user adoption.

Decentralized Governance

A key aspect of Aleph Zero’s inflationary policy is its commitment to decentralized governance. The platform envisions a future where token holders can vote on critical decisions, including adjustments to the inflation rate. This participatory approach ensures that the inflation mechanism remains responsive to the ecosystem’s evolving needs, balancing the interests of various stakeholders to support the platform’s long-term success.

MUST READ: “Aleph Zero vs Solana“

Regulatory Compliance and Market Presence

- FINMA No-Action Letter: Aleph Zero’s compliance with Swiss law and the implications for its operation and token issuance.

- Market and Wallets: Insights into Aleph Zero’s market presence, including exchanges and wallet statistics.

Key Takeaways

Conclusion

The economy of Aleph Zero showcases a thoughtful approach to creating a sustainable and growing blockchain ecosystem. Through strategic token allocation Aleph Zero is poised to contribute significantly to the blockchain landscape. As the platform evolves, its economic strategies will likely serve as a benchmark for future blockchain projects.

If you are interested in utilizing Aleph Zero, Solana or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

FAQ

How is the AZERO token distribution structured?

- The distribution is designed to support the ecosystem’s growth, with allocations for stakeholders and strategic initiatives.

What role does inflation play in the Aleph Zero ecosystem?

- Inflation is used strategically to incentivize network participation and ensure sustainability.

What is the utility of AZERO tokens within the Aleph Zero ecosystem?

- AZERO tokens power the Aleph Zero ecosystem (validator node staking, DEX swap fees, collateral for wrapped assets in Liminal, fees for asset-wrapping and bridging on Liminal, network fees, and governance voting processes).

How does Aleph Zero handle inflation and its impact on the ecosystem?

- Aleph Zero introduces a systematic annual increase of 30 million AZERO tokens to encourage ecosystem growth, incentivize participation, fund the ecosystem treasury, and support long-term holding by distributing inflation rewards mainly to stakers, aiming to balance growth with token value maintenance.