Polygon is setting new standards for scaling solutions. A protocol created to build and connect Ethereum-compatible networks shows what the future of blockchain could look like.

Polygon, formerly known as the Matic network, is one of the top-rated solutions using side-chains of the blockchain to provide faster and cheaper transactions on Ethereum. In many ways, it resembles other Layer 2 projects such as Avalanche and Cosmos, but according to its creators, it is much more efficient and secure. Practice seems to confirm this.

What challenges Polygon is responding to?

Ethereum is the most widely used blockchain protocol, but it has a number of limitations, including:

- High transaction costs

- Low throughput

- Problematic UX

Many projects are now exploring the use of Ethereum-compatible blockchains as a way to mitigate these limitations while leveraging the benefits of the entire ecosystem. However, the market still lacks specialized frameworks to build such blockchains or a protocol to connect them. According to the developers of the Matic network, this causes fragmentation of ecosystems and brings with it serious development challenges.

Solutions

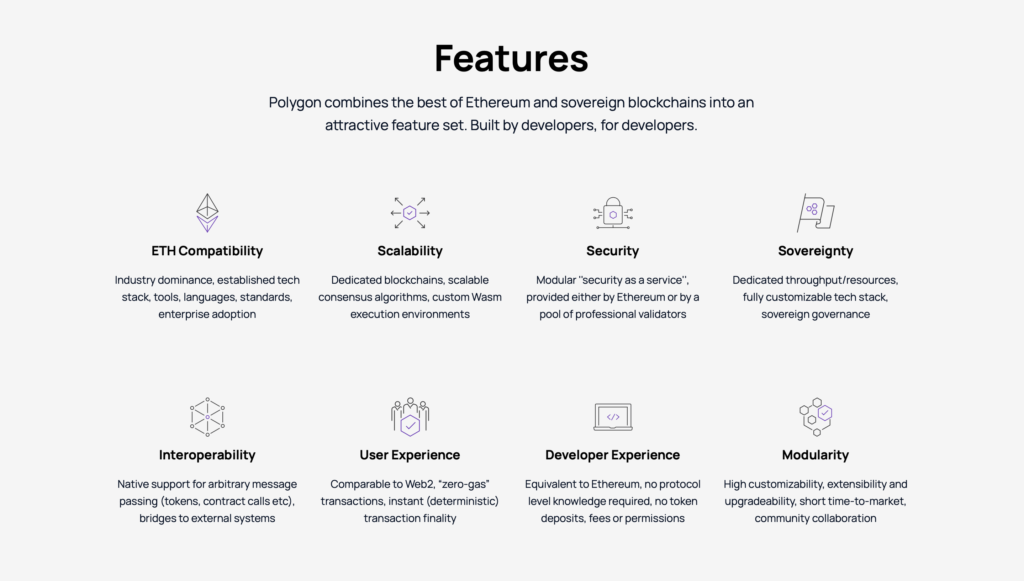

Polygon addresses these issues by implementing solutions such as:

- One-click deployment of turnkey blockchain networks

- A growing set of modules for creating custom networks

- An interoperability protocol for exchanging arbitrary data with Ethereum and other blockchain networks

- “Security as a service”

- Adapter modules to enable interoperability of existing blockchain networks

Polygon basics

As a Layer 2 solution, Polygon addresses the diverse needs of developers by providing tools to create scalable dApps that prioritize security, modularity and UX. This is made possible through a protocol architecture consisting of Proof of Stake (PoS) Commit Chains and More Viable Plasma (MoreVP).

In a nutshell, the operation of the Matic network relies on Commit Chains, which are transaction networks that run on the main blockchain, Ethereum. Commit Chains combine transactions into batches, which are then confirmed in bulk before returning the data to Ethereum.

DeFi moves to Polygon

Even the drop in Ethereum gas fees is not stopping more users and developers of decentralized finance from migrating to Polygon. Thanks to the low transaction price and speed of creating more blocks, the number of DeFi projects choosing to use it is growing rapidly. Among them are already Aave and Sushi Swap.

“There are advantages to using Layer 2 solutions, especially Polygon, because with DeFi, if the transaction cost is very high, for small players and casual speculators, participation just doesn’t make sense,” Sameep Singhania, founder of the QuickSwap exchange based on the protocol, said in an interview with CoinDesk. “That’s why I think it’s a good move that DeFi is moving to Polygon.”.

Polygon and Sushi Swap

How much the Matic network has grown in importance on the DeFi market is perfectly illustrated by the aforementioned Sushi Swap. According to DappRadar, the popular market maker in June this year had as many as 15 thousand registered wallets on Polygon and only a little over 4 thousand on Ethereum. This means that many more Sushi Swap users are currently on the Matic network than on Ethereum.

A similar relationship is observed on the decentralized exchange Aave, where the average daily transaction volume on Polygon oscillates around $6.75 million, significantly exceeding the $5 million on Ethereum. Coindesk reports that Aave began working with Polygon in March of this year to avoid the high transaction costs on Ethereum.

Token MATIC

The protocol has its own token – MATIC, whose value has managed to increase by 9000% for a year. It is currently the 15th cryptocurrency in terms of capitalization.

“Layer 2 solutions are a catalyst for growth and new users” said Mira Christanto, an analyst at Messari, a blockchain market research firm “Ethereum gas fees have been prohibitive for many users. Polygon and other Layer 2 solutions are precursors to demand for Ethereum once the gas fee hurdle is removed”.