In the era where innovation races against the clock, Aleph-Zero emerges from the horizon, challenging the status 'quo' of technology. This privacy-enhancing layer 1 protocol seeks to fine-tune the blockchain trilemma - security, scalability, and decentralization, that has plagued the predecessors. Let's embark on a journey to understand the essence of, guiding you through its labyrinth with clarity and creativity.

The Dawn of Aleph-Zero

Utilizes Directed Acyclic Graph (DAG) technology along with a classic blockchain structure. DAGs allow to simultaneous sharing the information between the nodes, exponentially growing their number each time. Constructed on the pillars of cryptographic methods, it stands as a bridge between idealistic visions and pragmatic use cases.

The Fabric of Aleph-Zero Innovation

Let's get through the patterns of design, highlighting its distinctive features.

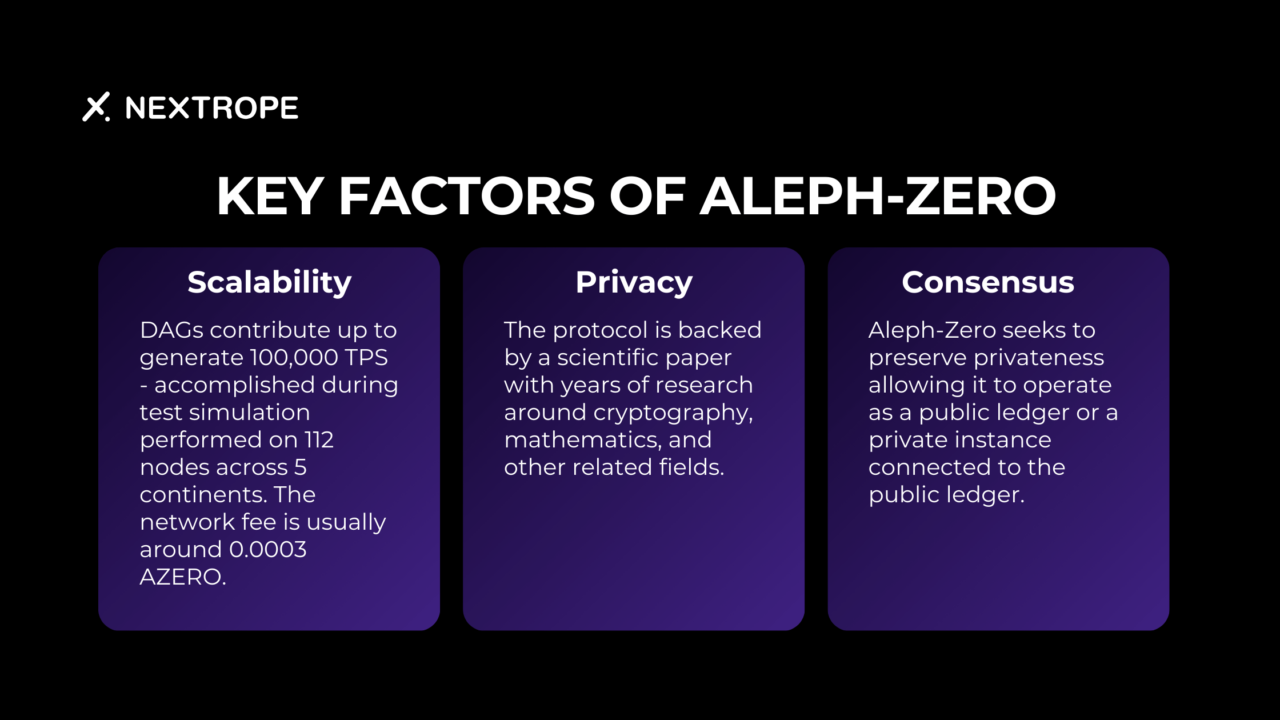

Scalability and Efficiency: The Dual Engines

Imagine a vast network, akin to the neural pathways of the human brain, where each connection represents a transaction. Aleph-Zero, unfettered by linear processing, allows for simultaneous transaction explosion such as thoughts racing your mind at the time. It is done thanks to DAG implementation, combined with blockchain framework, that ensures an unprecedented level of scalability and efficiency.

Security: Fortified Shield

Threats lurk constantly in the shadows, and thus security measures guard the privacy and integrity treasures. Aleph-Zero crafts this with the finest materials, including zero-knowledge proofs (ZKP) and secure Multi-Party Communication (sMPC). This solution allows the network to verify transactions with a whisper of information, never revealing the secrets it holds. It's like a castle with walls unseen, almost impregnable yet inviting.

Decentralization: The Democratic Heart

Aleph-Zero's network is a vibrant ecosystem where every node, every user, contributes to the harmony of its operation. The consensus mechanism not only celebrates but enforces the principle of equality among its participants.

Aleph-Zero Guiding Towards New Shores

It offers enough foundation for financial giants to tread upon, yet delicate to handle the most private transactions with care. As we gaze further, we begin to discern the outlines of new landscapes. These are the domains of decentralized finance, secure communication, and autonomous organizations - together drawing an unbounded future.

Conclusion

Considering the above, Aleph-Zero is an exploration of the current blockchain ecosystem constraints and a dream of its successful implications in the response. We will continue to peel back the layers, examining its use cases, architecture, and potential to boost adoption. We invite you to join us as we break down the particular segments of the protocol in the next articles.

If you are interested in utilizing Aleph-Zero or other blockchain-based solutions for your project, please reach out to contact@nextrope.com

FAQ

What is Aleph-Zero and what problem does it aim to solve?

- Aleph-Zero is a privacy-enhancing layer 1 protocol built on Directed Acyclic Graph (DAG) technology and blockchain structure. It aims to address the blockchain trilemma of security, scalability, and decentralization, which has been a challenge for previous blockchain protocols.

What security measures does Aleph-Zero employ?

- Aleph-Zero utilizes zero-knowledge proofs (ZKP) and secure Multi-Party Communication (sMPC) to safeguard privacy and integrity. These cryptographic methods enable the network to verify transactions without revealing sensitive information, ensuring a high level of security.

How does Aleph-Zero ensure decentralization in its network?

- Aleph-Zero's consensus mechanism promotes equality among participants, fostering a vibrant ecosystem where every node and user contributes to the network's operation.

en

en  pl

pl