In the cryptocurrency industry, Decentralized Finance (DeFi) has risen as a transformative power, allowing people to engage in various financial activities without requiring intermediaries. Yield Farming, a notable DeFi feature, has captured significant interest and popularity in recent years. It presents the opportunity for investors to earn considerable returns by supplying liquidity to decentralized protocols. Nevertheless, comprehending both the advantages and risks related to this practice is crucial for making informed investment choices and effectively navigating this ever-changing environment.

Yield Farming in DeFi Explained:

Essentially, Yield Farming is an approach that enables cryptocurrency holders to use their assets productively and receive additional rewards. In the realm of DeFi, it entails contributing liquidity to decentralized protocols, usually via liquidity pools, in return for appealing yields. This method allows users to lend or stake their assets, which the protocol subsequently employs for various purposes such as lending, borrowing, trading, or other financial actions. Participants obtain incentives in exchange for their involvement; these can take the form of interest, fees, or governance tokens. Yield Farming harnesses the potential of smart contracts and blockchain technology to establish a decentralized ecosystem where users can optimize their crypto holdings and produce passive income.

More about yield farming

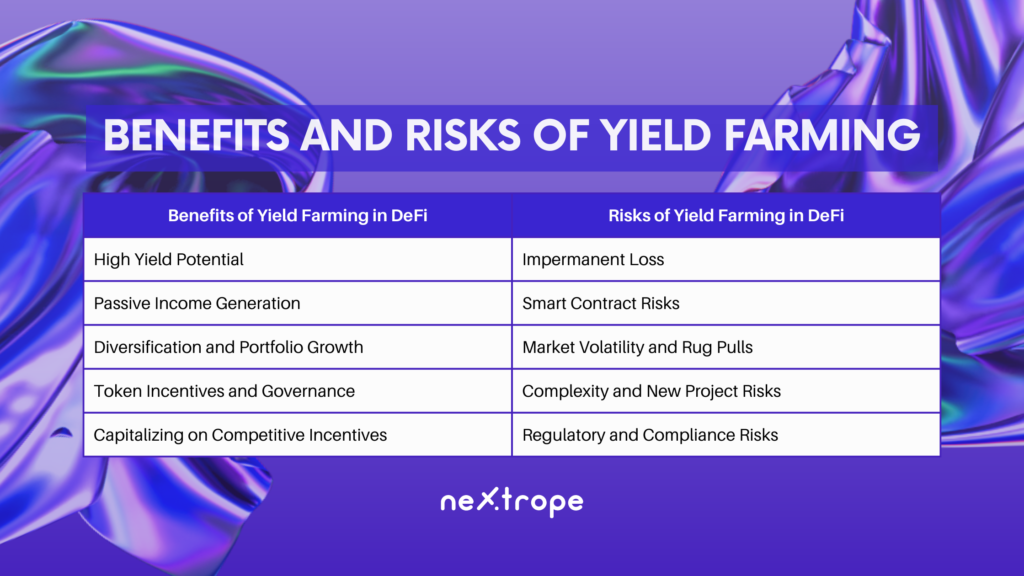

Benefits of Yield Farming in DeFi

Engaging in Yield Farming within the DeFi realm presents numerous benefits for cryptocurrency owners, such as:

- Elevated Yield Possibilities: Compared to traditional financial tools, participants can potentially attain significantly increased returns.

- Generation of Passive Revenue: Decentralized protocol liquidity suppliers can accrue passive income via interest, fees from transactions, or governance token rewards.

- Growth and Diversification of Portfolio: Yield Farming in DeFi enables individuals to broaden their crypto portfolios by distributing assets among various protocols and strategies, thereby potentially enhancing overall portfolio expansion.

- Token Rewards and Governance Involvement: Governance tokens can be obtained by participants, offering not only financial incentives but also granting voting privileges and sway over the protocol's ongoing development.

- Leveraging Competitive Inducements: Due to the competitive aspect of the DeFi landscape, protocols frequently present appealing incentives to encourage liquidity contributions, enabling users to capitalize on these enticements.

- Opportunities for Compounded Returns: By re-investing earned rewards into the Yield Farming process, participants may compound their returns progressively, resulting in exponential growth.

Possible Risks of Yield Farming in DeFi:

When participating in Yield Farming within the DeFi sector, there are specific risks one must be cautious of, such as:

- Impermanent Loss: Fluctuations in asset values may lead to impermanent loss, where the worth of the supplied liquidity might decline compared to holding the assets individually.

- Smart Contract Threats: DeFi platforms depend on smart contracts that might have weak spots or coding mistakes, possibly causing financial losses or exploitation by ill-intentioned individuals.

- Market Unpredictability and Rug Pulls: The unpredictable nature of cryptocurrency markets can affect the value of rewards obtained through Yield Farming. Furthermore, participants are exposed to the danger of deceptive projects or "rug pulls," where developers desert the project and confiscate investors' money.

- Intricacy and Emerging Project Dangers: The quickly developing DeFi field results in a constant influx of new projects and protocols. Engaging with unproven or unfamiliar projects entails inherent risks.

- Regulatory and Compliance Concerns: DeFi operates in a relatively unregulated setting, and shifting regulations or legal ambiguity may influence the landscape, presenting risks for participants.

Managing Risks in Yield Farming within DeFi

In order to successfully engage in Yield Farming in the DeFi realm and minimize potential dangers, adhering to best practices and adopting risk management tactics is vital. Here are some essential factors to consider:

Due Diligence and Investigation: Prior to participating in Yield Farming, thoroughly study projects, protocols, and teams. Thoroughly evaluate the fundamentals of the project, security audits, community reputation, and past performance to make educated choices.

Strategies for Reducing Risk: By investing in a variety of projects and protocols, you can limit your exposure to any single hazard. Set attainable goals and dedicate an appropriate percentage of your portfolio to Yield Farming initiatives.

Maintain Your Knowledge: Stay up-to-date on market trends, news updates, and regulatory developments. To keep informed about possible risks and opportunities, join community forums, follow social media channels, and consult reliable sources.

Safeguard Your Assets: Give priority to the protection of your assets by using best practices such as hardware wallets, multi-factor authentication activation, and regular security updates. Exercise caution concerning phishing attacks and refrain from divulging sensitive information.

Examine and Assess: Keep an eye on your Yield Farming activities' performance continuously. Pay close attention to any changes in project dynamics, protocol modifications, or market factors that may impact your investments.

Seek Expert Advice: Consult with professionals like financial advisors or blockchain specialists if you require guidance or are unsure about anything. They can offer tailored recommendations based on your individual situation and risk preferences.

By adhering to these best practices and employing risk management techniques, you can improve your likelihood of success and safeguard the capital you invest while participating in Yield Farming in the DeFi space.

Conclusion

In conclusion, Yield Farming in DeFi offers both enticing benefits and associated risks. As a method for cryptocurrency holders to maximize their assets and generate passive income, Yield Farming presents the potential for high yields, diversified portfolios, and token rewards with governance involvement. Participants can leverage competitive incentives and compound their returns over time. However, it is essential to navigate this landscape with caution, as impermanent loss, smart contract vulnerabilities, market volatility, fraudulent projects, and regulatory uncertainties pose risks to participants.

To engage in Yield Farming in DeFi successfully, thorough research and due diligence are crucial. It is important to evaluate the risks and rewards of individual projects, understand the smart contract mechanisms, and stay informed about market conditions. Implementing risk management strategies, diversifying investments, and setting realistic expectations can help mitigate potential risks.

en

en  pl

pl